1. 6. How to optimize effectiveness in the fashion supply chain: DHL’s solutions and involvement in the Fashion industry and suppliers

1.1. Nicolas Moúze

1.1.1. Commercial Director

1.1.2. DHL

1.1.3. Iberia

1.2. DHL & fashion

1.2.1. logistics partner for fashion week

1.2.2. hubs in world

1.3. solution for optimization

1.3.1. 1s choice fashion industry

1.3.2. give support

1.4. ecommerce EU

1.4.1. home delivery

1.4.2. drop off point

1.4.3. pack station

1.5. conclusions

1.5.1. reduce cost

1.5.2. end to end value

2. Q&A

2.1. cont replenish ment costs

2.1.1. carrying cost

2.1.1.1. need collab

2.1.1.1.1. to run it down

2.2. where are we going?

2.2.1. near term

2.2.1.1. china > bangladesh

2.2.1.1.1. New node

2.2.1.2. vietnam

2.2.1.2.1. no viable

2.2.1.3. cambodja

2.2.1.3.1. no viable

2.2.2. alternative to china

2.2.2.1. space

2.2.2.2. agricult > industry

2.2.2.3. only place

2.2.2.3.1. central africa

2.2.2.4. watch at lead indicators

2.2.2.4.1. textiles

2.2.2.4.2. position of textile there will be the place

2.2.3. near sourcing is attractive

2.2.4. driver low cost nickle en dimes

2.2.5. holistic SC

2.2.5.1. LA is closer to where you sell

2.2.5.2. rapis replenisment

2.2.5.3. demand signal

2.2.5.4. only a week laad time

2.2.5.5. driver

2.2.5.5.1. nickel dime

2.2.5.5.2. short lead time

2.2.5.5.3. oil prices

2.2.5.5.4. where are the real cost

2.2.6. forcus on tim to consumer

2.3. fast fashion

2.3.1. recycle

2.3.2. collect cutting loses

2.3.2.1. 85% is used

2.3.2.2. 15% not

2.3.3. water costs are high for cotton

2.3.4. has conflict with environ

2.3.5. model: buy new stuff

2.3.5.1. no sells no money

2.3.6. sust?

2.3.6.1. sust thru the chain

2.3.6.1.1. wool mixex with chems

2.4. consumer wants fast fashion

2.4.1. how to make it sust

2.4.2. consumers want it now in huge choice

3. 5. New eBiz Developments - one language for faster supply chains

3.1. Andreas Schneider

3.1.1. Managing Partner

3.1.2. GCS Consulting

3.1.3. Germany

3.2. Mauro Scalia

3.2.1. Project Manager

3.2.2. EURATEX

3.2.3. Belgium

3.3. system

3.3.1. erp

3.3.2. etc

3.3.3. example gerry webber

3.3.3.1. has 60 it system

3.3.3.2. to much

3.3.4. trade of complexity vs specilization

3.4. SCM IT

3.4.1. upstream

3.4.1.1. goods

3.4.1.2. info

3.4.1.3. money

3.4.2. downstream

3.4.3. specilization vs complexity

3.5. germany where hit by

3.5.1. zara

3.5.2. h&m

3.6. develop standards

3.6.1. same language is key

3.6.1.1. processes

3.6.1.1.1. business

3.6.1.1.2. technology

3.6.2. speak same language

3.6.3. GS1

3.6.3.1. cluster bus. models

3.6.4. mgn vertical buss models

3.6.5. 1 toolbox for whole SC

3.6.5.1. define stnd processes

3.7. 100% digital process > 20% saving

3.7.1. organize it

3.7.2. global stnds

3.7.3. build a basis

3.7.3.1. ie product recall

3.8. echange data in harmonized way

3.8.1. stop ie using faxes

3.8.2. digital comms

3.9. ebiz TCF

3.9.1. bus processes

3.9.2. models for documents

3.9.3. product identification

3.9.4. reference architecture

3.10. key mgmt task

3.10.1. adverising the system

3.10.2. forward preso

4. 4. Fashionomics: The new economics of Fashion

4.1. Bob McKee

4.1.1. Fashion Industry Strategy Director

4.1.2. INFOR

4.1.3. USA

4.2. intro

4.2.1. we all say the same stuff

4.2.2. fashion bus. model needs to change

4.2.3. wait till it 50%, at 70% off then consumer will buy

4.2.4. no1 cost is fashion value chain

4.2.4.1. cost of mark downs

4.2.4.2. supplier > retailer problem

4.3. industry

4.3.1. pressure

4.3.2. cons pay less

4.3.3. supp charge more

4.3.4. issues

4.3.4.1. bad environ

4.3.4.2. reg & law issues

4.3.5. do things differnely

4.3.5.1. collab

4.4. unit cost

4.4.1. fabric price increases

4.4.2. oil incr

4.4.2.1. synthetic

4.4.2.2. machines

4.4.3. hedging for costs

4.5. commodity

4.5.1. open market

4.5.2. fear for overflooding land

4.6. devaluation of RMB

4.7. economies

4.7.1. esprit example

4.7.1.1. the made profit

4.7.1.2. less then expected by analist

4.7.1.3. value went down

4.7.2. macys

4.7.2.1. lay of 20000 people

4.7.2.1.1. no consumers

4.7.2.2. stock price up

4.7.3. shocks

4.8. global industry

4.8.1. lead industrial revolution

4.8.2. UK > USA

4.8.2.1. UK: regulation issues

4.8.2.2. USA: got tired

4.8.2.3. pushed to Asia

4.8.3. Japan

4.8.4. Taiwan

4.8.5. Korea

4.8.6. Singapore

4.8.7. Thailand

4.8.8. Honk Kong

4.8.9. China

4.9. China

4.9.1. normal ec evolution

4.9.2. cost of labor up

4.10. listen to consumers

4.10.1. partner thru value chain

4.10.2. know down barriers

4.11. fashionomics

4.11.1. social networking

4.11.2. http://www.threadless.com/

4.11.2.1. social community

4.11.2.2. that woudl look good on a shirt

4.11.2.3. they vote on designs

4.11.2.4. then prodcuced

4.11.2.5. no design costs

4.11.2.6. no risks except size

4.11.2.7. succesful

4.11.2.8. next thing

4.11.2.8.1. flavoured tea

4.12. use socialnetnetworking

4.12.1. honestly

4.13. mission

4.13.1. focus on changes

4.13.2. buyers do jobs

4.13.3. bus. model

4.13.4. buyers with 40% efficient is not good

4.13.5. shorten time

4.13.6. supply to value chain

4.13.7. listen to consumer

4.13.7.1. supply wat they want

5. 3. high end of tailor womens wear

5.1. 3. Jan Hilger

5.1.1. Director Operations Formalwear

5.1.2. ESCADA

5.1.3. Germany

5.2. sourcing

5.2.1. go east

5.2.2. end up in EU again

5.3. just-style.com

5.3.1. era of cheaper garments is over

5.3.2. david birnbaum

5.3.3. 2025 80% of major apparel come from 20 large groups

5.4. win win

5.4.1. large / small

5.5. premium luxury is

5.5.1. 4% volume

5.5.2. 8% of value

5.6. fabric comes from italy

5.6.1. few fact closed down

5.6.2. less player

5.6.2.1. innov go down

5.7. issue

5.7.1. secure know how

5.7.2. high complexity

5.7.3. luxury indust is pain in the ass

5.8. unhealthy competition

5.9. work together

5.9.1. 10 woman wears companies

5.9.1.1. larger volume

5.9.2. sharing ideas

5.9.3. networks

5.9.4. info and connection

5.10. high end fashion cluster

5.10.1. put brains together

5.10.1.1. clothing technician

5.10.1.2. checks on brands

5.10.2. people talk to eachother

5.11. synergies

5.11.1. innovation pool

5.11.2. ship together etc

5.12. collabortation

5.12.1. a solution to tackle

5.12.2. if you cant dream you cant do it

6. 2. Expanding Sourcing Strategies Beyond the Low Cost Needle

6.1. Kurt Cavano

6.1.1. Founder, Chairman and Chief Strategy Officer

6.1.2. TradeCard, Inc.

6.1.3. USA

6.2. intro

6.2.1. started in 1999 Tradecard

6.2.1.1. came from tech space

6.2.1.2. went to apparel space

6.2.2. SC tech to revolutionize sourcers

6.3. economy

6.3.1. global ec is strugglin

6.3.2. chinese garment ass.

6.3.2.1. they have a an inventory of 3 years for domestic china!

6.3.3. fast fashion

6.3.3.1. sust & green

6.4. supplier challenges

6.4.1. diff communicating

6.4.2. etc.

6.5. low cost needle

6.6. eliminate days & dollars from SC

6.6.1. solution look at tools

6.6.1.1. compress way

6.6.1.1.1. supplies

6.6.1.1.2. buyers

6.7. cycle time

6.7.1. a week less increase margin by 12%

6.7.2. sign dolard value form every week out of SC

6.8. find ways on stripping away costs

6.9. cases

6.9.1. columbia

6.9.1.1. produce fleece

6.9.1.1.1. is big

6.9.1.1.2. needed a new warehouse

6.9.1.2. direct ship to retailers

6.9.1.3. everybody profts

6.9.2. bauer

6.9.2.1. personaize hockey sticks in china

6.9.2.2. ship them to use

6.9.2.2.1. split and deliver it directly

6.9.3. my addidas

6.9.4. belk

6.9.4.1. diff sizes based on geography

6.9.4.2. get right sizes

6.9.4.3. connect buyer with factory

6.9.5. guess

6.9.5.1. early payment programme

6.10. savings in SC

6.10.1. set of partners

6.10.2. use tech

6.10.3. benefit for all

7. 1. Countering Supply Chain Challenges with a cloud-based IT-system

7.1. Guido Brackelsberg

7.1.1. Managing Director

7.1.2. Setlog GmbH

7.1.3. Germany

7.2. intro

7.2.1. is it all about price?

7.2.1.1. yes but

7.2.1.2. TCO

7.2.1.3. it side

7.2.2. next step

7.2.2.1. optimising proccesses

7.2.2.2. lots of bilateral relationships

7.3. global supply chain

7.3.1. share workflow with all partners

7.3.2. integrate everyone

7.4. global supply chain integration

7.4.1. software is as good as it is being used

7.4.2. partners are part of supply chain

7.4.3. collab platfrom

7.4.3.1. if partners see benefit

7.4.3.2. they use it

7.4.4. everyone in value chain will integrate

7.5. ecological sust

7.5.1. case basler

7.5.1.1. intgerate supplier

7.5.1.2. no

7.5.1.2.1. xls

7.5.1.2.2. mails

7.5.1.3. achievements

7.5.1.3.1. CO2 reduction 45%

7.6. economic sust

7.6.1. tom tailor

7.6.1.1. shorten lead times

7.6.1.2. if i not make a sale im not making money

7.6.2. lot of efficiencies possible

7.7. social

7.7.1. lots of sourcing countries are muslim

7.7.2. integrate them

7.8. summary

7.8.1. economic

7.8.2. ecologica;

7.8.3. social

7.8.4. there an be fat out

7.8.4.1. internet tech can help do that

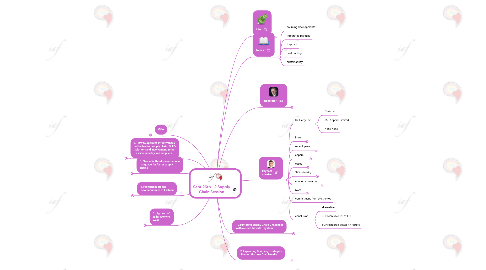

8. info

8.1. welcome to the live mind mapping stream

8.2. Mind Mapped by Alexis van Dam from Connection of Minds

8.3. This mind map will be live updated during the keynotes and forum

8.4. What is a mind map? please click

8.5. contents will be noted in main and subtopics

8.6. this mind map can be viewed on a mobile device

9. topics

9.1. sourcing developments

9.2. integrated planning

9.3. logistics

9.4. cost cutting

9.5. sustainability

10. moderator

10.1. Paulo Nunes de Almeida

10.2. Ex-ATP President

10.3. AEP Foundation President

10.4. Portugal

10.5. intro

10.5.1. huge pleasure to be here

10.5.2. entrepreneur in textile

10.5.3. general way of doing business

11. keynote speaker

11.1. Dr. Harry Lee

11.1.1. Chairman

11.1.2. TAL Apparel Limited

11.1.3. Hong Kong

11.2. intro

11.2.1. how to create value in supply chain

11.2.2. late 1990s

11.2.2.1. buyer can buy form country supplier/ factory

11.2.2.2. quote premium

11.2.2.3. move to china

11.2.2.3.1. cheaper

11.2.2.3.2. more capacity

11.2.3. china

11.2.3.1. land cost low

11.2.3.1.1. collect more taxes then from farmers

11.2.3.1.2. factories located 1-2 hrs from Hong Kong

11.2.3.2. retailers

11.2.3.2.1. cost of goods decreases

11.2.3.2.2. most retailers

11.3. recent years

11.3.1. china

11.3.1.1. wages increase by 20%

11.3.1.2. appreciation of RMB

11.3.1.3. hard to find labour

11.3.1.4. cost increase

11.3.2. retailer

11.3.3. supplier

11.3.3.1. close business

11.3.3.2. move to lower price country

11.3.4. China

11.3.4.1. higer cost

11.3.4.2. good infrastructure

11.3.4.3. good mgmt

11.3.4.4. value added services

11.3.5. moving to 3rd worl country

11.3.5.1. longer

11.3.5.1.1. fabric trim

11.3.5.1.2. production lead time

11.3.5.1.3. shippign time

11.3.5.2. less wel etsbalished mgmt

11.3.5.3. good: lower ex factory cost

11.4. apparel

11.4.1. apparel trade

11.4.1.1. first cost may not be best choice

11.4.2. SKU itensity

11.4.2.1. color

11.4.2.2. size

11.4.2.3. style

11.4.2.4. fabric

11.4.2.5. example gillett

11.4.2.6. apparel trade

11.4.2.6.1. SKU intensity

11.4.2.6.2. huge mark downs

11.4.3. soft $

11.4.3.1. material cost

11.4.3.2. prod cost

11.4.3.3. inventort

11.4.3.4. operation

11.4.3.5. sg&a

11.4.3.6. marked down

11.4.3.7. profits

11.5. cases

11.5.1. case 1

11.5.1.1. world leading branded garment wholesaler

11.5.1.2. objective

11.5.1.2.1. shorted leadtime

11.5.1.2.2. imp service level

11.5.1.2.3. inc inventory turn

11.5.1.2.4. mgd score card

11.5.1.3. replenisment time

11.5.1.3.1. 150 to 60 days

11.5.1.4. benefit

11.5.2. case 2

11.5.2.1. clicks & mortar

11.5.2.1.1. non iron shirt

11.5.2.2. objective

11.5.2.2.1. 50% jump in business

11.5.2.3. partnerships

11.5.2.4. replenisment

11.5.2.4.1. shorten leadtime

11.5.2.4.2. mgn sizes

11.5.2.5. result

11.5.2.5.1. inventory turns

11.5.2.5.2. in stock rate

11.5.2.5.3. weekof supply

11.5.2.5.4. better plan from supply side

11.5.3. case 3

11.5.3.1. read & react

11.5.3.2. better forecast

11.5.3.2.1. save money

11.6. SKY intensity

11.6.1. SCM

11.6.1.1. incr sales

11.6.1.2. decr mark downs

11.7. economic environ

11.7.1. slow economy

11.7.1.1. us

11.7.1.2. eu

11.7.1.3. china

11.7.2. diff t make profit

11.8. SCM

11.8.1. 20 years now

11.8.2. few succes cases

11.8.2.1. why

11.8.2.2. obstacles buyer side

11.8.2.2.1. 1st prio

11.8.2.2.2. 2nd prio

11.8.2.3. manuf side

11.8.2.3.1. lowest corst to customers

11.8.2.3.2. schedule production

11.8.2.3.3. quality

11.8.2.3.4. human rights

11.8.2.3.5. environmental

11.8.3. succesful in SCM?

11.8.3.1. buyer side

11.8.3.2. common goal

11.8.3.2.1. buss model

11.8.3.3. GMROI

11.8.3.3.1. gros marging ROI

11.8.4. how to align with supply

11.8.4.1. communicate

11.8.4.2. setup goals

11.8.4.3. score cards

11.8.4.4. award order to better perform

11.8.5. entire SC

11.8.5.1. suppliers

11.8.5.2. common goals: service cust better

11.8.6. strong parnership

11.8.6.1. perfect rel.ship

11.9. commitment from the the top

11.10. conclusion

11.10.1. alternative

11.10.2. SCM can save 1/3 of FOB

11.10.3. SCM can prod better fin results