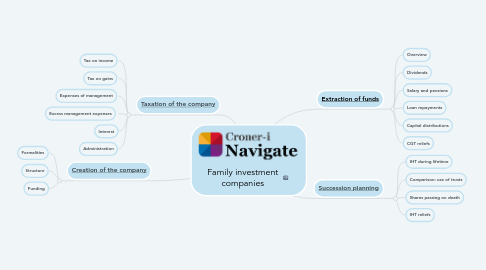

Family investment companies

by stephanie webber

1. [Taxation of the company](https://library.croneri.co.uk/po-heading-id_PUYtdTKaskSmlNuT-MBffA)

1.1. Tax on income

1.2. Tax on gains

1.3. Expenses of management

1.4. Excess management expenses

1.5. Interest

1.6. Administration

2. [Creation of the company](https://library.croneri.co.uk/po-heading-id_oJieGxl6x0exYq9d1v-B0Q)

2.1. Formalities

2.2. Structure

2.3. Funding

3. [Extraction of funds](https://library.croneri.co.uk/po-heading-id_Zc3xbq56hU2YGZndY3b9dg)

3.1. Overview

3.2. Dividends

3.3. Salary and pensions

3.4. Loan repayments

3.5. Capital distributions

3.6. CGT reliefs

4. [Succession planning](https://library.croneri.co.uk/po-heading-id_E35YCdfJpUmqU9Q7CBFMPg)

4.1. IHT during lifetime

4.2. Comparison: use of trusts

4.3. Shares passing on death

4.4. IHT reliefs