Plan Assest

da Ahmad Faozan

1. Determining cost of plant assets

1.1. Land

1.2. Land improvments

1.3. Buildings

1.4. Equipment

2. Expenditures during useful life

2.1. Maintain

2.2. Increase

2.3. Materiality

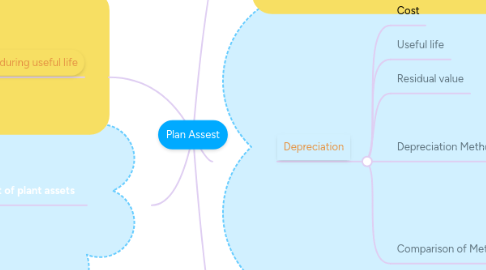

3. Depreciation

3.1. Cost

3.2. Useful life

3.3. Residual value

3.4. Depreciation Methods

3.4.1. 1. Straight-line

3.4.2. 2. Units-of-activity

3.4.3. 3. Declining-balance

3.5. Comparison of Methods

3.5.1. 1. Component Depreciation

3.5.2. 2. Depreciation And Income Taxes

3.5.3. 3. Revising Periodic Depreciation

4. Plant asset disposals

4.1. Sale,Retirement and Exchange

4.2. Retirement Of Plant Assets

4.2.1. Record this Retirement

4.2.1.1. Acc Depr-Equip

4.2.1.2. Equipment

4.2.2. accumulated depreciation on a plant asset exceed its cost

4.2.2.1. Acc DEpr-Equip dan Loss on Disposal of Plan Assets

4.2.2.2. Equipment

4.3. Sale of Plan Assets

4.3.1. Gain on Sale

4.3.2. Loss On Sale

5. Revaluation of Plant Assets

5.1. 1. Straight-line depreciation

5.1.1. Depreciation Expense

5.1.2. Accumulated Dep-equipment

5.2. 2. Record the revaluation

5.2.1. Acc Dep-Equipment

5.2.2. Equipment Revaluation Surplus

5.3. 3. Statement of financial position

5.3.1. Equipment Acc Dep-Equ

5.3.2. Revaluation Surplus