1. Free Trade: The absence of government-imposed barriers, such as quotas, or duties, that impede the free flow of goods and services between countries

1.1. Benefits: Gains from trade when a country specializes in the manufacturing and export of products that have low-opporunity costs and import products that have high-opportunity costs

1.2. Weaknesses: Importing products in certain industries from other countries takes away job opportunities for the home country

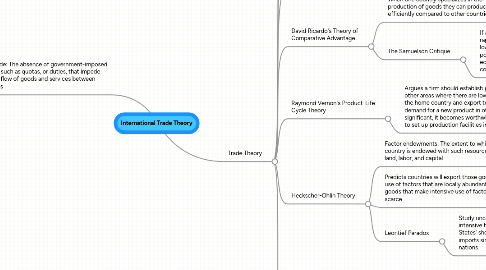

2. Trade Theory

2.1. New Trade Theory

2.1.1. Theory predicts that nations that are home to firms that gained first mover advantage in certain products may have an advantage in the trade of those products

2.1.1.1. First mover advantage: the economic and strategic advantages that accrue to early entrants into an industry

2.1.2. Economies of Scale: unit cost reductions associated with a large scale of output

2.2. Mercantilism

2.2.1. Economic philosophy advocating that countries should simultaneously encourage exports and discourage imports

2.2.1.1. Problem: Zero-Sum Game, which is a situation where a gain by one country results in a loss by another

2.3. Adam Smith's Theory of Absolute Advantage

2.3.1. When one country is more efficient than any other country in producing a particular product

2.4. David Ricardo's Theory of Comparative Advantage

2.4.1. When one country specializes in the production of goods they can produce more efficiently compared to other countries.

2.4.1.1. Comparative advantage arises from differences in production

2.4.2. The Samuelson Critique

2.4.2.1. If a rich country enters into a free trade agreement with a poor country that rapidly improves it productivity after the introduction of a free trade regime, the lower prices the rich country's consumers pay for the imported goods from the poor country may not be enough to produce a net gain for the rich country's economy if the dynamic effect of free trade is to lower real wage rates in the rich country

2.5. Raymond Vernon's Product-Life Cycle Theory

2.5.1. Argues a firm should establish production facilities in other areas where there are low labor costs compared to the home country and export to other regions. When demand for a new product in other countries becomes significant, it becomes worthwhile for the innovating firm to set up production facilities in those countries.

2.5.1.1. Based on the 20th century United States market

2.6. Heckscher-Ohlin Theory

2.6.1. Factor endowments: The extent to which a country is endowed with such resources as land, labor, and capital

2.6.1.1. Comparative advantage arises from differences in factor endowments

2.6.2. Predicts countries will export those good that make intensive use of factors that are locally abundant while importing goods that make intensive use of factors that are locally scarce

2.6.3. Leontief Paradox

2.6.3.1. Study uncovered the United States' exports were less capital intensive than its imports, while according to this theory the United States' should have capital intensive exports and labor intensive imports since it was relatively abundant in capital compared to other nations

2.7. Porter's Diamond of National Competitive Advantage

2.7.1. Argues four broad attributes of a nation shape the environment in which local firms competes and these attributes promote or impede the creation of competitive advantage

2.7.1.1. Factor Endowments

2.7.1.1.1. A nation's position in factors of production such has skilled labor or the infrastructure necessary to compete in an industry

2.7.1.2. Demand Conditions

2.7.1.2.1. The nature of home demand for the industry's product or service

2.7.1.3. Firm Strategy, Structure, and Rivalry

2.7.1.3.1. The conditions governing how companies are created, organized and managed and the nature of domestic rivalry

2.7.1.4. Relating and Supporting Industries

2.7.1.4.1. The presence or absence of supplier industries and related industries that are internationally competitive