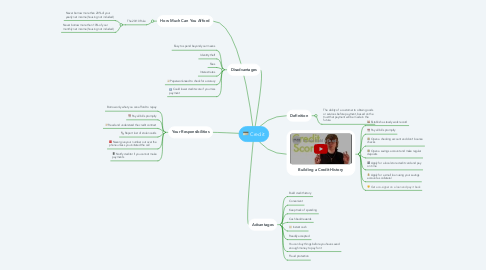

Credit

by Connie McSweeney

1. Disadvantages

1.1. Easy to spend beyond your means

1.2. Identity theft

1.3. Fees

1.4. Interest rates

1.5. Paperwork-need to check for accuracy

1.6. Could lower credit score if you miss payment

2. Advantages

2.1. Build credit history

2.2. Convenient

2.3. Keep track of spending

2.4. Cash back/rewards

2.5. Instant cash

2.6. Readily accepted

2.7. You can buy things before you have saved enough money to pay for it

2.8. Fraud protection

3. Your Responsibilities

3.1. Borrow only what you can afford to repay

3.2. Pay all bills promptly

3.3. Read and understand the credit contract

3.4. Report lost of stolen cards

3.5. Never give your number out over the phone unless you initiated the call

3.6. Notify creditor if you cannot make payments

4. How Much Can You Afford

4.1. The 20/10 Rule

4.1.1. Never borrow more than 20% of your yearly net income (housing not included)

4.1.2. Never borrow more than 10% of your monthly net income (housing not included)