1. 1. Control Account

1.1. 1.1 Bank Account

1.1.1. 1.1.1 Control the Links to login Internet banking. Keep sercurity the ID and password. .

1.1.2. 1.1.2 Update balance fluctuations, update all data payment into Accounting software and The Relation Report

1.2. 1.2 Other Account Control the Links to login Software. Keep sercurity the ID and password. Any changes made to the system must be printed out in hard copy.

1.2.1. 1.2.1 Tax page

1.2.2. 1.2.2 Insurance Software

1.2.3. 1.2.3 Accouting software

1.3. 1.3 Visa card

1.3.1. 1.3.1 Purpose Using Advertising on Facebooks, Google, Linkedin… or payments for international purchases and sales approved by BODs

1.3.2. 1.3.2 Method Payment (task of Accounting Dept)

1.3.2.1. 1.3.2.1 Receive bank statement from banker

1.3.2.2. 1.3.2.2 Receive Invoice from relation Department

1.3.2.3. 1.3.2.3 Make Payment Request + FCT tax payment

1.3.2.4. 1.3.2.4 Send document payment to BODs approval

1.3.2.5. 1.3.2.5 Visa card payment via Internet banking and FCT tax payment via page: thuedientu.gov by token

2. 2. Control Funds

2.1. 2.1 Cash on hand. The maximum amount payable by cash is 20 million.

2.2. 2.2 Balance of Bank. All payment via bank must be approved by BODs by OPT

2.3. 2.3 Note: Regularly update balance of funds in relevant reports as well as accounting software

3. 3. Control Debit

3.1. 3.1 Receivable - Payable

3.1.1. 3.1.1 Control Receivables - Payables for each Customers, control all information about debt arising date, ending date and debt payment plan

3.1.2. 3.1.2 Inform to each customer of overdue debts

3.2. 3.2 Pay to State Budget (VAT - PIT - FCT tax..)

3.2.1. 3.2.1 Making Tax report monthly

3.2.2. 3.2.2 Double check internal report with annouce of govement report.

3.3. 3.3 Pay to Employees

3.3.1. 3.3.1 Double check Working time table from HR department

3.3.2. 3.3.2 Calculate salary + PIT tax everymonth

3.3.3. 3.3.3 Payment salary to employee, note: advance salary and other deduction....

3.4. 3.4 Others

3.4.1. 3.4.1 Control the loan and others payment

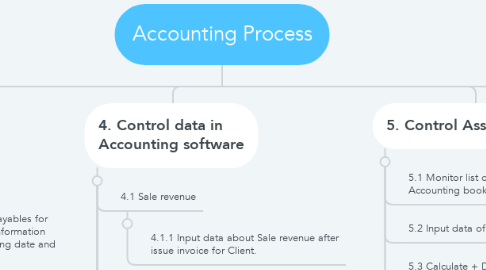

4. 4. Control data in Accounting software

4.1. 4.1 Sale revenue

4.1.1. 4.1.1 Input data about Sale revenue after issue invoice for Client.

4.2. 4.2 Expense

4.2.1. 4.2.1 Update data about expense after receive Invoice or payment request.

4.3. 4.3 Cash flow

4.3.1. 4.3.1 Update changes in cash flow as soon as possilble

4.3.2. 4.3.2 Update the balance fluctuations

4.4. 4.4 Note

4.4.1. 4.4.1 Accounting Rules: Circular 200/2014/TT-BTC

4.4.2. 4.4.2 Guaranteed the rightness, the honest and the timely

4.5. 4.5 Closing book

4.5.1. 4.5.1 Doing Deprecation + prepaid expense slip

4.5.2. 4.5.2 Transfer slip

4.5.3. 4.5.3 Closing book

5. 8. Report

5.1. 8.1 Weekly report

5.1.1. 8.1.1 Report about Cash flow of this week. Actual Income - Out money. And schedule about money for next week.

5.1.2. 8.1.2 In Friday, Accounting Department will send report via email to BODs

5.2. 8.2 Monthly report

5.2.1. 8.2.1 Report about Profit and Loss of this month. Analysis of sale revenue and expense change trend

5.2.2. 8.2.2 At the first week of next month, Accounting Dept will send report via email to BODs

5.3. 8.3 Tax Report (VAT + PIT + FCT + Using invoice ....)

5.3.1. 8.3.1 VAT report must be made by month, and payment by quater. Accountant have control all Income - Out Invoice

5.3.2. 8.3.2 PIT report must be made by month after payment salary, and payment by quater. At the end of year, Accountant makes the finalize report tax

5.3.3. 8.3.3 FCT tax must be made by month and payment by month. FCT tax payment for foreign supplier.

5.4. 8.4 Financial Yearly Report

5.4.1. 8.4.1 Financial Yearly Report include: PIT finalize Report, CIT finalize Report, Finalcial Report. Send Yearly Report via thuedientu.gov page by token before 31/03 of next year.

6. 6. Payment Process

6.1. 6.1 Direct Payment (Have Red Invoice)

6.1.1. 6.1.1 Received Document Payment from relation department (Payment Request, Red Invoice, Contract, Minutes of Acceptance...)

6.1.2. 6.1.2 Accountant Dept check document: completeness, Invalid...

6.1.3. 6.1.3 Send Document Payment to BODs approval

6.1.4. 6.1.4 Payment by cash or via Bank (after approval)

6.2. 6.2 Advance payment (Dont have Red Invoice)

6.2.1. 6.2.1 Received advance money payment from relation department (Advance money payment request, Contract, Estimate expense table...)

6.2.2. 6.2.2 Accountant Dept check document: completeness, invalid...

6.2.3. 6.2.3 Send Advance payment ro BODs appoval

6.2.4. 6.2.4 Payment by Cash or via Bank (after approval)