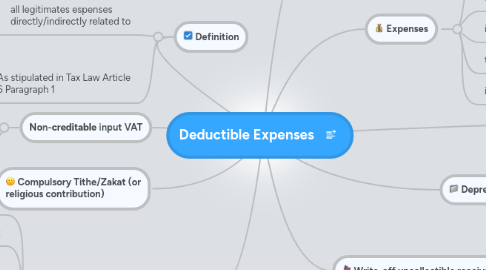

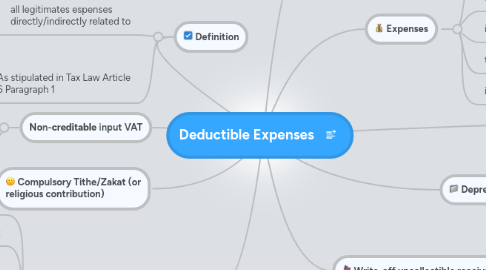

Deductible Expenses

por Jasmine Alhabsyi

1. Definition

1.1. all legitimates espenses directly/indirectly related to

1.1.1. earning income

1.1.2. collecting income

1.1.3. maintaining income

1.2. As stipulated in Tax Law Article 6 Paragraph 1

2. Donations and expenses for

2.1. national disasters

2.2. research and development

2.3. educational facilities

2.3.1. provided that following requirements are met

2.3.1.1. corporate income tax must be in fiscal profit

2.3.1.2. donations supported with sufficient doc.

2.3.1.3. institution that received donations must registered as taxpayer

2.4. sports development

2.5. social infrastructure

3. Compulsory Tithe/Zakat (or religious contribution)

4. Non-creditable input VAT

4.1. that has been paid and incurred from a transaction that related to earning, collect, and maintain income

5. Expenses

5.1. material expense

5.2. salary, wages expense

5.3. interest, dividend, and royalty

5.4. traveling expense

5.5. insurance premium

6. Depreciation and amortization expense

7. Promotion and selling expenses

7.1. provided that a nominative list in a required format is available and the expenses constitute the cumulative amount of the following costs

7.1.1. cost of advertising; electronic/print/other media

7.1.2. cost of product exhibition

7.1.3. cost of introducing new product

7.1.4. cost of sponsorship

8. Losses from sale or transfer

8.1. that are owned and used in company to obtain, collect, and maintain income

9. Write-off uncollectible receivables

9.1. provided that following conditions are met

9.1.1. write-off must have booked as expense

9.1.2. taxpayer must submit list of uncollectible exp. to DGT

9.1.3. collection case has been brought to DGT/there is nulification