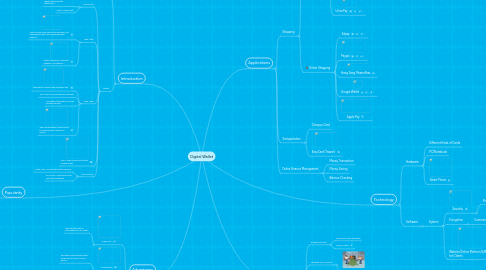

1. Introduction

1.1. definition

1.1.1. A system that securely stores users' payment information and passwords for numerous payment methods and websites.

1.2. history

1.2.1. before1992

1.2.1.1. POS(point of sale), soft/hardware digital wallet, prepaid mechanism.

1.2.1.2. Not in a large scale.

1.2.2. 1993~1995

1.2.2.1. Some simple credit card online payment, e.g. exchanging credit card number through internet.

1.2.2.2. Safety regulations: Netscape invented SSL standard.

1.2.3. 1995~1998

1.2.3.1. Bank sector invented and promoted SET.

1.2.3.2. SET: financial online payment standard.

1.2.3.3. Use digital certification to verify personal identity.

1.2.3.4. 1998: the European Union started to draft the law of electronic money.

1.2.4. 2004: Japan DoCoMo promote "mobile wallet"

1.2.5. 1999~persent

1.2.5.1. credit cards - most of the online payment.

1.2.5.2. 3D-Secure: credit card online verification standard

2. Advantages

2.1. lower cost

2.1.1. removes the need for intermediaries, e.g. cashier

2.2. Convenience

2.2.1. purchase in few seconds with a simple tap or scan of mobile device

2.3. introduce business opportunities

2.3.1. different form of payments

2.3.2. increase potential revenue

2.4. consumption behavior can be studied(under the willingness of the consumer)

2.4.1. provide personal financial plan or shopping service

3. Popularity

3.1. Object

3.1.1. Child

3.1.2. Teenager

3.1.3. Adult

3.1.4. Elder

3.2. Transaction(VISA and Mondex)

3.2.1. Service Area

3.2.2. Trading Volume

4. Applications

4.1. Shopping

4.1.1. Daily Shopping

4.1.1.1. Octopus Card

4.1.1.2. Hang Seng MasterPass

4.1.1.3. EPS

4.1.1.4. UnionPay

4.1.2. Online Shopping

4.1.2.1. Alipay

4.1.2.2. Paypal

4.1.2.3. Hang Seng MasterPass

4.1.2.4. Google Wallet

4.1.2.5. Apple Pay

4.2. Transportation

4.2.1. Octopus Card

4.2.2. EasyCard (Taiwan)

4.3. Online Finance Management

4.3.1. Money Transaction

4.3.2. Money Saving

4.3.3. Balance Checking

5. Technology

5.1. Hardware

5.1.1. Different Kinds of Cards

5.1.2. PC/Notebook

5.1.3. Smart Phone

5.2. Software

5.2.1. System

5.2.1.1. Security

5.2.1.1.1. Pin Code

5.2.1.2. Encryption

5.2.1.2.1. Commerce Transaction

5.2.1.3. Website/Online Platform/APP for Clients

5.2.1.3.1. Online Trading

5.2.1.3.2. Account Management

6. Disadvantages

6.1. Doubtful Security

6.1.1. Risk about Online Shopping

6.1.2. Case or News

6.2. Shopping Out of Control

6.2.1. Wasting Money

6.3. Purchasing Unnecessary Goods

6.4. Low Quality of Goods

6.4.1. Photo Online

6.4.2. Real Photo