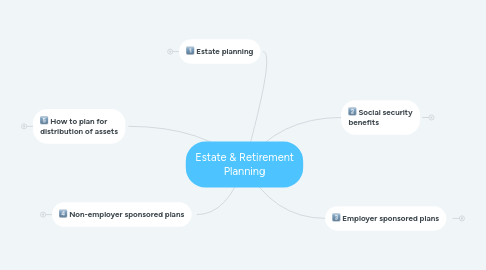

1. Estate planning

1.1. are the arrangements you make for the administration & distribution of your assets when you die.

2. Social security benefits

2.1. 4 types of eligiblity:

2.1.1. fully insured

2.1.1.1. requires 40 credits (10+ years of work)

2.1.1.2. eligible for retirement, survivors, disability programs

2.1.2. currently insured

2.1.2.1. requires 6 credits in last 3 years

2.1.2.2. eligible for some survivors & disability

2.1.2.3. not eligible for retirement benefits

2.1.3. transitionally insured

2.1.3.1. for workers who reach age of 72 without 40 credits

2.1.3.2. eligible for limited retirement benefits

2.1.4. not insured

2.1.4.1. <72 years old with < 6 credits

2.2. amount to be received

2.2.1. computed using the average of your highest 35 years of earnings

3. Employer sponsored plans

3.1. features

3.1.1. tax-sheltered

3.1.1.1. earnings not subject to income taxes

3.1.2. pretax money

3.1.2.1. money amount prior to taxes

3.1.3. tax deferred

3.1.3.1. taxes are not paid until money is taken out

3.1.4. tax-free withdrawal

3.1.4.1. removal of cash from a retirement account with taxes assessed

3.2. government regulated

3.2.1. qualified plans

3.2.1.1. IRS approved for special treatment

3.3. 3 Common types of plans:

3.3.1. defined contribution

3.3.1.1. provides retiree a lump-sum

3.3.1.2. most popular plan

3.3.1.3. best know plan is 401-K

3.3.2. defined benefit

3.3.2.1. pays a lifetime of monthly payments

3.3.2.2. also called a Pension

3.3.3. cash-balance

3.3.3.1. combines defined benefit plan + interest earning account

3.3.3.2. 2 components:

3.3.3.2.1. defined benefit plan

3.3.3.2.2. interest bearing account where a % of pay is put each month

4. Non-employer sponsored plans

4.1. Roth IRA

4.1.1. funded with after-tax money

4.1.2. growth & withdrawals not taxed

4.2. Individual Retirement Account (IRA)

4.2.1. an account that holds investments

4.2.2. tax-deferred growth

4.3. Keogh & SEP-IRA

4.3.1. Keogh

4.3.1.1. for high income self-employed & small business owners

4.3.2. SEP-IRA

4.3.2.1. for sole proprietor's self-employment income

4.3.2.2. easier to set-up & maintain than a Keogh

5. How to plan for distribution of assets

5.1. set-up assets as nonprobate property

5.2. transferred by contract

5.2.1. beneficiary

5.2.2. property ownership designation

5.2.2.1. joint tenancy

5.2.2.1.1. each spouse owns all the asset

5.2.2.1.2. one spouse can dispose of it without approval of other spouse

5.3. transfer by will

5.3.1. probate property

5.3.1.1. all assets not probateable

5.3.2. transfers non probateable assets to heirs

5.3.3. if you die without a will:

5.3.3.1. called intestate

5.3.3.2. probate court will decide what to do with your assets