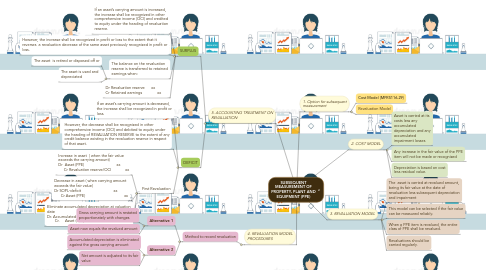

1. 5. ACCOUNTING TREATMENT ON REVALUATION

1.1. SURPLUS

1.1.1. If an asset’s carrying amount is increased, the increase shall be recognized in other comprehensive income (OCI) and credited to equity under the heading of revaluation reserve.

1.1.2. However, the increase shall be recognized in profit or loss to the extent that it reverses a revaluation decrease of the same asset previously recognized in profit or loss.

1.1.3. The balance on the revaluation reserve is transferred to retained earnings when:

1.1.3.1. The asset is retired or disposed off or

1.1.3.2. The asset is used and depreciated

1.1.4. Dr Revaluation reserve xx Cr Retained earnings xx

1.2. DEFICIT

1.2.1. If an asset’s carrying amount is decreased, the increase shall be recognized in profit or loss.

1.2.2. However, the decrease shall be recognized in other comprehensive income (OCI) and debited to equity under the heading of REVALUATION RESERVE to the extent of any credit balance existing in the revaluation reserve in respect of that asset.

1.2.3. First Revaluation

1.2.3.1. Increase in asset ( when the fair value exceeds the carrying amount) Dr Asset (PPE) xx Cr Revaluation reserve/OCI xx

1.2.3.2. Decrease in asset ( when carrying amount exceeds the fair value) Dr SOPL-deficit xx Cr Asset (PPE) xx

1.2.3.3. Eliminate accumulated depreciation at valuation date Dr. Accumulated depreciation xx Cr. Asset (PPE) xx

2. 4. REVALUATION MODEL PROCEDURES

2.1. Method to record revaluation

2.1.1. Alternative 1

2.1.1.1. Gross carrying amount is restated proportionately with changes

2.1.1.2. Asset now equals the revalued amount

2.1.2. Alternative 2

2.1.2.1. Accumulated depreciation is eliminated against the gross carrying amount

2.1.2.2. Net amount is adjusted to its fair value