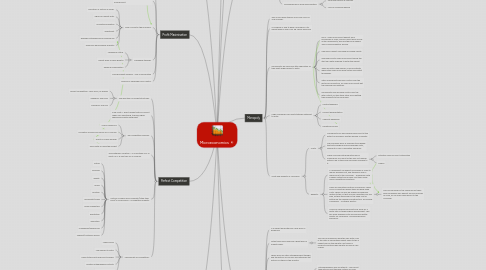

1. Costs

1.1. Fixed Costs

1.1.1. Total Fixed Costs

1.1.2. Average Fixed Costs

1.2. Variable Costs

1.2.1. Total Variable Costs

1.2.2. Average Variable Costs

1.3. Returns

1.3.1. Constant Returns to Scale

1.3.2. Rising/Diminishing Returns to Scale

1.4. Short or Long Run

1.5. TC=TFV+TVC

1.5.1. TC=ACxQ

1.5.2. TFC=AFCxQ

1.5.3. TVC=ACVxQ

1.6. Revenue

1.6.1. Marginal Revenue = change in total revenue over change in output

2. Profit Maximisation

2.1. Normal Profit = what is sufficient to keep all factors of prodn. in their current use. Occurs where AC=AR.

2.2. Supernormal profit = anything in excess of normal profit.

2.3. Role of Profit in the economy:

2.3.1. Allocation of factors of prodn.

2.3.2. Signal for market entry

2.3.3. Promotes innovation

2.3.4. Investment

2.3.5. Rewards entrepreneurs for bearing risk

2.3.6. Economic performance indicator

2.4. Managerial theories

2.4.1. Managerial Status

2.4.2. Market share or sales growth

2.4.3. Revenue maximisation

2.5. Principle agent problem - lack of information

2.6. Divorce of ownership from control

3. Perfect Competition

3.1. The spectrum of market structures:

3.1.1. Perfect competition: Many firms, no brands

3.1.2. Oligopoly: few firms

3.1.3. Monopoly: one firm

3.2. Sunk costs = spent money that you cannot regain. eg: advertising, training, highly specialised capital equipment.

3.3. The competitive process:

3.3.1. Scarce resources

3.3.2. Formation of prices via forces of SS and DD

3.3.3. Profits or losses emerge

3.3.4. Firms enter or leave the market

3.4. The shutdown condition = P is less than AVC in short run. P is less than AC in long run.

3.5. Factors on which firms compete (other than price) in IMPERFECTLY competitive markets:

3.5.1. Extras

3.5.2. Bonuses

3.5.3. Quality

3.5.4. Brand

3.5.5. Location

3.5.6. Exclusivity/image

3.5.7. Green credentials

3.5.8. Reputation

3.5.9. Innovation

3.5.10. Uniqueness/differences

3.5.11. Support/customer service

3.6. The benefits of competition:

3.6.1. Lower prices

3.6.2. Low barriers to entry

3.6.3. Lower total profits and profit margins

3.6.4. Greater entrepreneurial activity

3.6.5. Economic efficiency

4. Contestable Markets

4.1. This maintains that it is not the number of firms in an industry but the levels of barriers to entry that determines a firm's behaviour.

4.2. According to this theory, a market is completely contestable when the costs of entry and exit by potential rivals are zero, and when entry can be very rapid.

4.3. The level of sunk costs that a firm might encounter also determines contestability. These include:

4.3.1. Capital inputs that are specific to an industry or cannot be resold.

4.3.2. Money spent on advertising, marketing and research and development projects.

4.3.3. Training

4.4. In reality though, no market is perfectly contestable.

4.5. Existing firms may still protect themselves with barriers to entry.

4.6. Often there is insufficient information about a market to enter it effectively.

4.7. When markets are contestable, it is expected that there are lower profit margins.

5. Efficiency

5.1. Consumer surplus = the difference between the price a consumer is willing to pay and the market price

5.2. Producer surplus = the difference between the price a firm is prepared to sell at and the market price.

5.3. Static efficiency is a given point in time (Allocative, productive, x)

5.4. Dynamic efficiency is over time (Product, process)

5.5. Allocative efficiency: P = MC (S=D) Goods are produced in line with consumer preferences.

5.6. Productive efficiency: Lowest point on average cost curve

5.7. X Inefficiency = occurs when firms are not producing on their AC curve. Often owing to 'organisational slack', normally associated with monopoly

5.8. Product innovation: this creates new markets and is the driving force in most markets. Creates differences between products. This is good for the consumer.

5.9. Process innovation involves finding different and more efficient ways of producing a product.

5.10. Supply-side strategies are usually linked directly with attempts to promote more innovative behaviour in firms.

5.11. Deadweight loss = the welfare loss associated with monopoly power.

6. Concentrated markets

6.1. C.R.5 = the value of output from the 5 largest firms / value of output for the industry

6.2. Why do firms grow larger?

6.2.1. Market power motive - this gives greater pricing power

6.2.2. Objectives of managers - growth might be achieved as a result of the pursuit of managerial status

6.2.3. Profit motive - firms want to expand and make profit, but the stimulus to achieve this growth often comes from the stock market. therefore the valuation of a firm in the stock market is influenced by expectations of future growth

6.2.4. Economies of scale - this allows companies to raise profit margins and improve productive capacity.

6.2.5. Risk motive - the desire to diversify and reduce risk could male a company want to grow and expand. Similar to economies of scope.

6.3. How do firms grow larger?

6.3.1. Internal growth - this uses the profit and capital of the company to expand by increasing fixed and variable factors

6.3.2. External growth - this is a rapid route for growth, and can be more effective than internal growth, but it sometimes bears more risk.

6.3.2.1. Horizontal integration = two businesses at THE SAME STAGE OF PRODUCTION merge

6.3.2.2. Vertical integration = acquiring a business at a DIFFERENT STAGE OF THE SUPPLY CHAIN

6.3.2.3. Lateral merger = between two companies that are RELATED BUT NOT IDENTICAL. eg newspapers and magazines

6.3.2.4. Conglomerate merger = between firms in UNRELATED BUSINESS

6.3.3. Outsourcing - sending parts of the production process overseas. Three main drivers for this:

6.3.3.1. Technological change

6.3.3.2. Increased competition

6.3.3.3. Pressure from the financial markets

7. Price Discrimination

7.1. This occurs when a producer sells an identical product to different buyers at different prices for reasons unrelated to costs.

7.2. Conditions for price discrimination

7.2.1. Differences in PED

7.2.2. Keeping markets separate. Stop 'market seepage'

7.3. Types of price discrimination

7.3.1. First degree: Each consumer gets a different price

7.3.2. Second degree: Batch related

7.3.3. Third degree: Different segments of the market. Differentiated by time, location and geography

7.4. Consequences of price discrimination

7.4.1. Consumer surplus is reduced.

7.4.2. Loss of consumer welfare

8. Monopoly

8.1. This occurs when there is only ONE FIRM IN THE MARKET

8.2. A company is said to have a monopoly if its market share is over 25%. eg. Tesco have 30%

8.3. Monopolists will face very little opposition as they exert huge barriers to entry:

8.3.1. Price - small firms cannot benefit from economies of scale, and so cannot price as low as the monopolists, who are the price makers. This is called predatory pricing.

8.3.2. New firms cannot command any brand loyalty

8.3.3. High fixed costs: small firms cannot afford the start up capital required to enter the market

8.3.4. There are often legal barriers, such as patents, which stop small firms using certain innovative techniques

8.3.5. Often monopolists will have control over the factors of production, so small firms cannot get the required raw materials

8.3.6. Monopolists also will have control over the retail outlets, so this stops other firms getting their products to the consumer.

8.4. Large companies can exert strategic deterrent to entry:

8.4.1. Hostile takeovers

8.4.2. Product differentiation

8.4.3. Capacity expansion

8.4.4. Predatory pricing

8.5. Costs and benefits of Monopoly:

8.5.1. Costs:

8.5.1.1. Monopolists can earn supernormal profit at the extent of efficiency and the welfare of society.

8.5.1.2. The monopoly price is assumed to be higher that both marginal and and average costs, leading to a loss of allocative efficiency.

8.5.1.3. There could be both productive and x inefficiency as a result of the firm not making optimal use of the scare resources available to it.

8.5.1.3.1. Potential cause for Govt. intevention

8.5.1.3.2. Ofgem

8.5.2. Benefits:

8.5.2.1. A monopolist can exploit economies of scale to reduce average cost, and therefore offer a lower price to the consumer. - Equilibrium with a higher output and a lower cost than under more competitive conditions.

8.5.2.2. There are sometimes natural monopolies. These occur in industries where there are huge fixed costs. There can also be regional monopolies related to this, in that one firm operates over one area, as they have paid for the fixed cost of setting up the required infrastructure . eg. Energy companies - Southern Electric

8.5.2.2.1. This can be good for the consumer as these large companies also benefit from economies of scale, so can offer lower prices to the consumer

8.5.2.3. Long run supernormal profits can allow for a faster rate of technological development. This will lower average costs and produce better quality for consumers. Increased dynamic efficiency.

9. Oligopoly

9.1. Is a market dominated by a few firms or producers

9.2. Often these firms exercise a great deal of market power.

9.2.1. This can be measured using the CR5 Ratio. This is the ratio of percentage market share to the 5 largest firms in the industry. eg. tobacco products and the sugar industry all have a CR5 of 99%.

9.3. These firms are often interdependent though, and the actions of one firm will determine the actions of others in the industry.

9.4. An oligopoly usually exhibits the following features:

9.4.1. Interdependence and uncertainty - firms must take into account the likely actions of rivals.

9.4.2. Entry barriers. - these maintain supernormal profits for the dominant firms.

9.4.3. Product branding - each of the firms in the oligopoly will brand their products distinctively, and attempt to differentiate their products.

9.4.4. The firms will engage in non-price competition. This could be offering loyalty cards, staying open longer, lower delivery fees etc..

9.5. The basic question for oligopolistic firms is: Collude or Compete?

9.6. There are two main theories of oligopoly:

9.6.1. The kinked demand curve

9.6.1.1. This assumes that the other firms are unlikely to match another firm's price raise, but will match a price fall.

9.6.2. Game theory

9.6.2.1. This attempts to predict the likely behaviour of other firms. The prisoner's dilemma is an example of this.

9.7. Price Leadership occurs when one dominant firm sets the price level, and all others follow.

9.8. Tacit collusion is when firms secretly make deals and let some in on decisions, and not others.

9.9. Price fixing and explicit collusion is often found where firms attempt to maximise joint profits.

9.10. In order to collude on price, the producers must be able to exert some control over market supply.

10. Market Structure and Technology

10.1. Market Structure is best defined as the organisational and other characteristics of a market.

10.2. The most important features to consider to determine the market structure are:

10.2.1. The number of firms

10.2.2. The Concentration Ratio

10.2.3. The nature of costs in the market

10.2.4. The degree to which the industry is vertically integrated

10.2.5. The extent of product differentiation

10.2.6. The structure of buyers in the industry. Monopsony?

10.2.7. The turnover of customers.

10.3. The three main market structures are:

10.3.1. Perfect competition

10.3.1.1. Many Firms

10.3.1.2. Homogeneous products

10.3.1.3. No barriers to entry

10.3.1.4. No supernormal LR profit, but Supernormal SR profit

10.3.1.5. No pricing power, the firms are price takers. They do not engage in non price competition

10.3.1.6. They attempt to maximise profits

10.3.1.7. The do not innovate - are not dynamically efficient

10.3.1.8. This never actually exists in the real world though

10.3.2. Oligopoly

10.3.2.1. There are few firms, but their products will be differentiated, quite often by brand.

10.3.2.2. There are high barriers to entry, and they receive both short and long run supernormal profit

10.3.2.3. They are quite often price makers, but there is often regulation too.

10.3.2.4. Non-price competition is rife, they innovate strongly, and attempt to maximise profits.

10.3.3. Monopoly

10.3.3.1. Only one firm in the market, or the firm is the market

10.3.3.2. Unique type of product and extremely high barriers to entry.

10.3.3.3. Short and long run supernormal profits

10.3.3.4. Strong pricing power - price maker

10.3.3.5. POTENTIALLY strong innovation, USUALLY profit maximising and POSSIBLY non price competition.