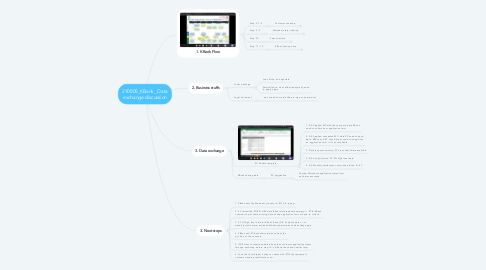

1. 1. KBank Flow

1.1. Step 3.1 - 4

1.1.1. Customer consents

1.1.1.1. Should separate flow based on where customers come (2 scenarios)

1.1.1.1.1. UC 1: Customers come from iPOS side

1.1.1.1.2. UC 2: Customers come from KBank or other partners and wanna have data from iPOS

1.2. Step 4 - 9

1.2.1. Merchant status sharing

1.2.1.1. iPOS suggest KBank to share their customer application status through each step

1.3. Step 10

1.3.1. Fees structure

1.3.1.1. 2 types of fees: application fee and data fee

1.4. Step 11 - 13

1.4.1. KBank sharing data

1.4.1.1. Can KBank share data of loans result and repayment data to SC? So that SC can detect abnormal signal in MC performance and alert KBank soon

2. 3. Data exchange

2.1. SC fill data template

2.1.1. 1. K-X Applied MC with the consents: data KBank need to collect from application form

2.1.2. 2. X-K Applied consented MC: data SC need to send back. KBank and SC consider put some missing data on application form if it's not available

2.1.3. 3. Data request summary: SC cross check data available

2.1.4. 4. X-K Analytics data: SC fills high level data

2.1.5. 5. K-X Monthly settlement: commission & fee for SC

2.2. KBank sharing data

2.2.1. SC suggestion

2.2.1.1. Sharing Merchants application status from each process steps

3. 3. Next steps

3.1. 1. KBank sent the Merchant consent for iPOS to review

3.2. 2. SC review the iPOS & HRV data (Sheet data request summary) -> SC & KBank consider to put some missing data on the application form (if need to collect)

3.3. 3. SC fill high level data for KBank (Sheet X-K Analytics data) -> to develop credit score, evaluate Merchant performance when they apply

3.4. 4. KBank and SC back their opinions about the position of the consents

3.5. 5. iPOS want to receive update about their customer application status through each step before step 10 -> KBank check and confirm later

3.6. 6. June check with team if they can share with iPOS the repayment, customer lending result data or not

4. 2. Business stuffs

4.1. Loans package

4.1.1. Loan limits: no negotiate

4.1.2. Second loans: don't allow repayment, need to apply again

4.2. Legal document

4.2.1. don't need to meet offline or sign any hard docs