1. Sole proprietorship

1.1. Characteristics:

1.1.1. Owned and managed by one person.

1.1.2. Operated in the owner’s name or under a trade name.

1.1.3. Indistinguishable from the owner.

1.1.4. Profits and losses flow directly to owner.

1.2. Advantages:

1.3. •Easiest and simplest form of organization. •Free of many regulations and formalities of other types of ownership. •Owner retains 100% of after-tax profits.

1.4. Disadvantages:

1.4.1. • Liability is unlimited (i.e. proprietor is fully personally liable for business obligations) • Capital is limited to what the owner can provide or borrow • Business is tied to owner. If owner is unable to manage due to illness, business operations could be seriously disrupted • Owner may not have adequate knowledge or skills or may lack time to do things properly

2. Corporation

2.1. Characteristics:

2.1.1. Separate legal entity from the shareholders.

2.1.2. Assets / liabilities acquired or owed belong to the corporation.

2.1.3. Can be terminated by bankruptcy, merger or voluntary dissolution.

2.1.4. Character depends on legislation of the jurisdiction it was incorporated in

2.2. Advantages:

2.2.1. • Greater access to capital than other structures • Liability to shareholders is restricted to investment • Profits are taxed in the company, and corporate tax rates are often lower than personal tax rates.

2.3. Disavantages:

2.3.1. • Incorporation can be expensive • More formal regulations • Complex tax rules • Corporation has no rights outside its articles of incorporation

2.4. Types of corporations:

2.4.1. 1. Private companies

2.4.2. 2. Public companies

2.4.3. 3. Professional corporations

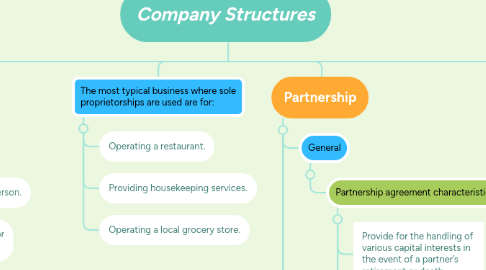

3. The most typical business where sole proprietorships are used are for:

3.1. Operating a restaurant.

3.2. Providing housekeeping services.

3.3. Operating a local grocery store.

4. Partnership

4.1. General

4.1.1. Partnership agreement characteristics:

4.1.1.1. Provide for the handling of various capital interests in the event of a partner’s retirement or death

4.1.1.2. Might prove to be difficult to attract additional partners if existing agreement creates barriers to entry.

4.1.1.3. Slow decision making may result from the fact that various partners’ voices have to be heard.

4.2. Limited

4.2.1. Limited partnership characteristics:

4.2.1.1. General partners manage the business.

4.2.1.2. Limited partners contribute capital (cash or other assets).

4.2.1.3. General partners have unlimited personal liability.

4.3. Advantages:

4.4. • Liability is limited only to the amount of capital contributed by limited partners • General partners can raise cash without involving outside investors in management of business. •All partners have limited liability • Flow-through taxation status (i.e. income generated is treated as personal income of the partners).

4.5. Disavantages:

4.5.1. • General partners are personally liable for business debts. • More expensive to create than general partnerships. • Suitable mainly for venture capital, private equity, or companies that invest in real estate. • Restricted to certain professions as physicians, attorneys, doctors, financial advisors, and accountants