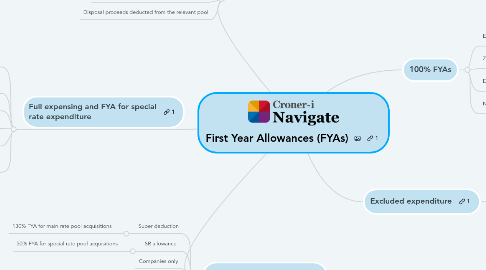

First Year Allowances (FYAs)

Laura Burrowsにより

1. How FYAs are given

1.1. Not automatic, must be claimed

1.2. Specified percentage, usually 100%

1.3. Claim in the period the expenditure is incurred

1.4. Disposal proceeds deducted from the relevant pool

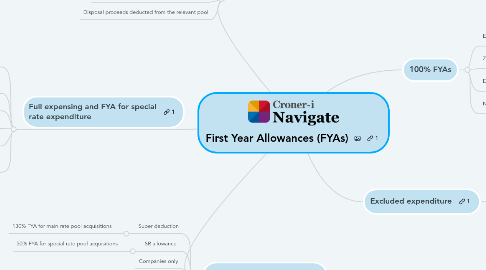

2. Full expensing and FYA for special rate expenditure

2.1. FYA

2.1.1. 100% FYA for main rate pool acquisitions

2.1.2. 50% FYA for special rate pool acquisitions

2.2. Companies only

2.3. Expenditure incurred on or after 1 April 2023

2.4. New assets only

2.5. General FYA exclusions apply

2.6. Immediate balancing charge on disposal

2.6.1. 100% of proceeds where 100% FYA claimed

2.6.2. 50% of proceeds where 50% FYA claimed

3. Super deduction and SR allowance

3.1. Super deduction

3.1.1. 130% FYA for main rate pool acquisitions

3.2. SR allowance

3.2.1. 50% FYA for special rate pool acquisitions

3.3. Companies only

3.4. Expenditure incurred between 1 April 2021 and 31 March 2023

3.5. New assets only

3.6. General FYA exclusions apply

3.6.1. Exclusion for leased assets modified

3.7. Balancing charge on disposal

3.7.1. Special rules for calculating