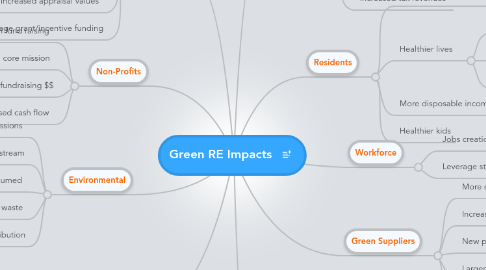

Green RE Impacts

por Jim Simcoe

1. Investors

1.1. Higher returns

1.2. Pride of 'Action'

1.2.1. Creating positive change

1.3. Safer investment

1.4. Lower capital expenses

1.5. Increased appraisal values

1.6. Leverage grant/incentive funding

2. Non-Profits

2.1. Focus less on fund raising

2.2. Focus more on core mission

2.3. Opportunity to increase fundraising $$

2.3.1. Can offer ownership in RE

2.4. Increased cash flow

3. Competitors

3.1. Blueprint to model

3.2. Tipping point of 'green' properties reached faster

4. Environmental

4.1. Lower CO2 emissions

4.2. Decreased contribution to waste stream

4.3. Less energy consumed

4.4. Recycle materials targeted for waste

4.5. Reduce landfill contribution

5. Community

5.1. Healthier residents

5.2. Increased home values

5.3. Political attention and power

5.4. Neighborhood beautification

5.5. Economic growth

5.6. Increased tax revenues

6. Residents

6.1. Lower utility expenses

6.2. Healthier lives

6.2.1. Lower healthcare expenses

6.2.2. Potential lower asthma, diabetes, etc

6.2.3. More productive living/working

6.3. More disposable income to pump into economy

6.4. Healthier kids

7. Green Suppliers

7.1. More customers

7.2. Increased demand lowers prices

7.3. New products enter market faster

7.4. Larger selection of products

7.5. Products available in more locations

8. Workforce

8.1. Jobs creation

8.2. Leverage state and federal grants

9. Housing Industry

9.1. Take bank owned properties off the market

9.2. Improve home values

9.3. Decrease vacancies

9.3.1. Decreased crime