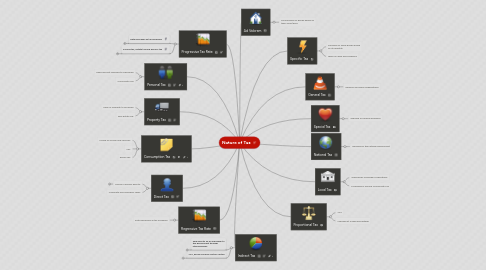

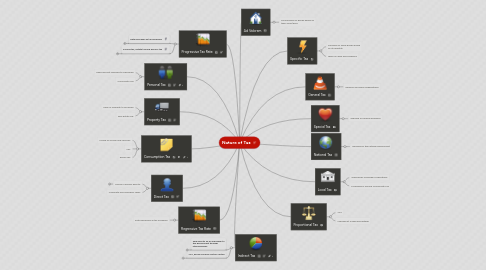

Nature of Tax

by Jerbie Mercado

1. Direct Tax

1.1. Paid by a person directly

1.1.1. Dr. Johny Appleseed

1.1.2. Reasons

1.2. Corporate and Individual Taxes

2. Progressive Tax Rate

2.1. Rate increases as tax increases

2.1.1. E-Mail

2.1.2. Phone

2.2. Income tax, Estate tax and donor's tax

2.2.1. E-Mail

2.2.2. Phone

3. Personal Tax

3.1. Fixed amount imposed to individuals

3.2. Community Tax

4. Property Tax

4.1. Value of Property to be levied

4.2. Real Estate Tax

5. Consumption Tax

5.1. Levied on Goods and Services

5.2. VAT

5.3. Excise Tax

6. Indirect Tax

6.1. Paid directly by an individual to the government through intermediaries

6.1.1. Budget

6.1.2. Authority

6.1.3. Need

6.1.4. Timeframe

6.2. VAT, Excise Tax and Custom duties

6.2.1. Budget

6.2.2. Authority

6.2.3. Need

6.2.4. Timeframe