1. Article

1.1. informative

1.2. 2nd/3rd person

1.3. casual style

2. Smart Investor Blueprint

2.1. Why Forex is Better

2.2. Smart investor

2.3. Practical plan

2.3.1. massive income, 2017

3. Financial Instruments

3.1. Stocks

3.2. FX (Foreign Exchange)

3.3. Affiliate Marketing

3.4. Bonds

3.5. Commodities

3.6. Energy Futures

3.7. Indices

3.8. ETFs (Exchange Traded Funds)

4. Rules of thumb

4.1. Avoid losing money, don't lose everything

4.2. never start something without adequate understanding/knowledge

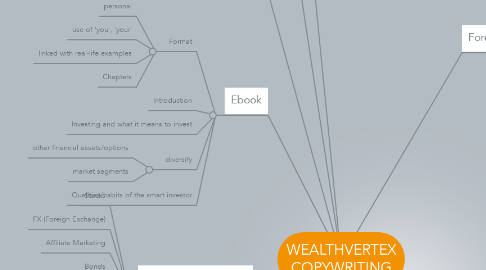

5. Ebook

5.1. Format

5.1.1. personal

5.1.2. use of 'you', 'your'

5.1.3. linked with real-life examples

5.1.4. Chapters

5.2. Introduction

5.3. Investing and what it means to invest

5.4. diversify

5.4.1. other financial assets/options

5.4.2. market segments

5.5. Qualities/habits of the smart investor

6. CTA (Call-to-Action)

7. Binary Options

7.1. "yes/"no" proposition

7.2. gains/losses are caped

8. Forex

8.1. Invest as a beginner

8.1.1. 1. Basics

8.1.1.1. types of currency pairs

8.1.1.1.1. 1. Crosses

8.1.1.1.2. 2. Majors

8.1.1.1.3. 3. Exotics

8.1.2. 2. Reading charts

8.1.3. 3. Best trading time frame

8.1.4. 4. Examples

8.1.5. 5. Social Trading

8.1.6. 6. Leverage

8.1.7. 7. Dollar-cost-averaging

8.2. Investing vs Smart Investing

8.3. Terminologies

8.3.1. spread

8.3.2. pip

8.3.3. base/quote currency

8.3.4. bid/ask price

8.3.5. bear/bull

8.3.6. short/long position

8.3.7. Dollar-cost-averaging

8.3.8. Resistance/support

8.3.9. Spread betting

8.4. Strategies

8.4.1. Bladerunner Trade

8.4.2. Daily Fibonacci Pivot Trade

8.4.3. Bolly Bang Bounce Trade

8.4.4. Forex Dual Stochastic Trade

8.4.5. Forex Overalapping Fibonacci Trade

8.4.6. London Hammer Trade

8.4.7. Bladerunner Reversal

8.4.8. Pop 'n' Stop Trade

8.4.9. Drop 'n' Stop Trade

8.4.10. Trading the Forex Fractal

9. Qualities of a smart investor

9.1. Patience

9.2. investing mindset

9.2.1. protect your capital

9.2.2. stop loss

9.2.3. long/mid term trading

9.3. Discipline

9.4. Keeping emotions in check

9.4.1. fear

9.4.2. greed

9.5. Always have a plan

9.5.1. exit strategies

9.5.2. long/short term goals

9.5.3. knowing your time frame

9.5.4. contingency planning

9.5.5. Steps to starting your investment

9.5.5.1. 1. Assess your current position

9.5.5.2. 2. Set goals

9.5.5.3. 3. Know your timeline

9.5.5.3.1. determine your liquidity needs

9.5.5.3.2. know when you would need the funds to meet your goals

9.5.5.4. 4. Assess your risks

9.5.5.5. 5. Diversify

9.5.5.5.1. Don't put all your eggs into one basket

9.5.5.6. 6. Decide who will manage your investments

9.5.5.6.1. some prefer a more hands-on approach

9.5.5.6.2. others want to allocate their time for other stuff and prefer if a professional manages their investments