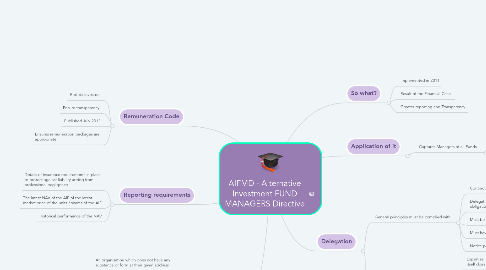

1. Letterbox entities

1.1. An organisation which does not have any substance or form at their given address

1.2. AIM: TO PREVENT THIS FROM ARISING SO NONE OF THE FOLLOWING CAN EXIST

1.2.1. No longer has sufficiently skilled staff to oversee activities undertaken by the delegate

1.2.2. No longer has access to the information or records

1.2.3. Delegate is undertaking greater part of the work than the AIFM itself

2. Reporting requirements

2.1. Details of insurance requirements in place to protect against liability arising from professional negligence

2.2. The latest NAV of the AIF of the latest market price of the units / shares of the AIF

2.3. Historical performance of the NAV

3. Remuneration Code

3.1. Protect Investors

3.2. Ensure transparency

3.3. Published July 2013

3.4. Ensures remuneration packages are appropriate

4. So what?

4.1. Implemented in 2011

4.2. Result of the Financial Crisis

4.3. Greater reporting and Transparency

5. Application of it

5.1. Captures Managers of all Funds

5.1.1. BUT AIFM has to have AUM in excess of

5.1.1.1. EUR 100m if leverage exists

5.1.1.2. EUR 50Om if no leverage exists

5.1.2. Perform Portfolio and Risk Management Functions (2 key responsibilities)

6. Delegation

6.1. General principles must be complied with

6.1.1. Contracts must be in writing

6.1.2. Delegation cannot avoid rights and obligations of both parties

6.1.3. Must be a robust oversight programme

6.1.4. Must have a disaster recovery plan

6.1.5. Notice provisions must be in place

6.2. Must give sufficient reason if delegating

6.2.1. Expertise in a certain area that the AIFM itself does not have

6.2.2. Cost savings for the AIF

6.2.3. Access of the delegate to global trading capabilities