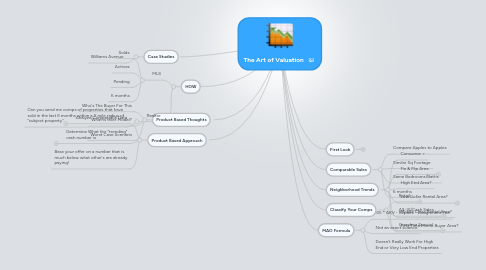

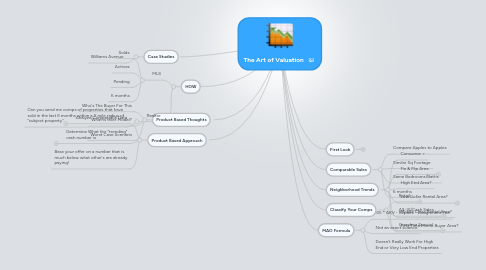

The Art of Valuation

da Adura Sanya

1. Product Based Thoughts

1.1. Who's The Buyer For This

1.2. What is thier Model?

1.3. Worst Case Scenario

2. Product Based Approach

2.1. Analyze Comparable Data

2.1.1. classify the data

2.1.2. pay attention to cash/as-is sales

2.1.3. Determine Retail Value IF possible

2.2. Determine What the "trending" cash number is

2.2.1. What range have other investors been paying?

2.3. Base your offer on a number that is much below what other's are already paying!

3. Case Studies

3.1. Williams Avenue

4. HOW

4.1. MLS

4.1.1. Solds

4.1.2. Actives

4.1.3. Pending

4.1.4. 6 months

4.2. Realtor

4.2.1. Can you send me comps of properties that have sold in the last 6 months within a X mile radius of "subject property".

5. First Look

5.1. What's Sold On The Street

5.1.1. The best kind of comp

5.2. What' Sold Within Acceptable Distance

5.3. What is the acceptable distance??

5.3.1. How far out are people going for comps

5.4. Radius Search

5.4.1. Whats sold with X distance of your subject property?

6. Comparable Sales

6.1. Compare Apples to Apples

6.2. Similar Sq Footage

6.3. Same Bedrooms/Baths

6.4. 6 months

7. Neighborhood Trends

7.1. Consumer >

7.2. Fix & Flip Area

7.2.1. Homeowners actively looking to purchase

7.3. High End Area?

7.4. Low Dollar Rental Area?

7.4.1. The Hood

7.5. Middle Class Rental Area?

7.6. First Time Home Buyer Area?

8. Classify Your Comps

8.1. Retail

8.1.1. Great condition - Newly Renovated

8.1.2. Owner Occupied

8.2. AS-IS/Cash Sales

8.2.1. Usually need work

8.2.2. Predominately investor sales

8.3. Grandma Special

8.3.1. Dated but still livable

8.3.2. Could be purchased by investor OR owner occupant