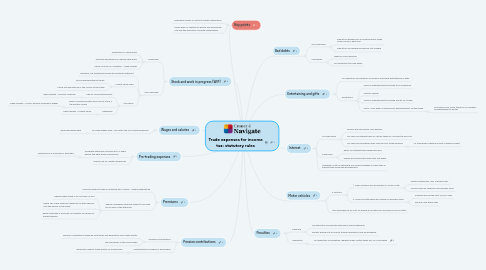

1. Key points

1.1. Legislation allows or restricts certain deductions

1.2. Rules apply in addition to wholly and exclusively rule and the exclusion of capital expenditure

2. Pension contributions

2.1. Personal contributions

2.1.1. Pension contributions made by sole trader not deductible from trade profits

2.1.2. Tax relief given in the normal way

2.2. Contributions on behalf of employees

2.2.1. Deduction against trade profits on a paid basis

3. Premiums

3.1. Premium paid by trader on entering into a lease = capital expenditure

3.2. Special rule where landlord subject to income tax on part of the premium

3.2.1. Applies when lease is for 50 years or less

3.2.2. Trader can claim relief for taxed part of the premium over the period of the lease

3.2.3. Relief restricted if only part of property occupied for trade purposes

4. Pre-trading expenses

4.1. Allowable expenses incurred up to 7 years before the date trade commences

4.1.1. Deducted as if incurred on that date

4.2. Similar rule for capital allowances

5. Wages and salaries

5.1. Accrued wages paid > 9m after end of accounting period

5.1.1. Deducted when paid

6. Stock and work in progress (WIP)

6.1. Cash basis

6.1.1. Deducted on a paid basis

6.1.2. Possible adjustment on leaving cash basis

6.1.3. Value of stock on cessation = trade receipt

6.2. Accruals basis

6.2.1. Generally, tax treatment follows accounting treatment

6.2.2. Market value used

6.2.2.1. Stock appropriated by trader

6.2.2.2. Stock not disposed of in the course of the trade

6.2.3. Cessation

6.2.3.1. Sale to unconnected party

6.2.3.1.1. Trade receipt = amount received

6.2.3.2. Sale to connected party and ITTOIA 2005, s. 178 election made

6.2.3.2.1. Trade receipt = cost or amount received if higher

6.2.3.3. Otherwise

6.2.3.3.1. Trade receipt = market value

7. Bad debts

7.1. Accruals basis:

7.1.1. Deduction allowed for accounting entry made under GAAP if debt bad

7.1.2. Deduction for general provisions not allowed

7.2. Cash basis:

7.2.1. Taxed on cash received

7.2.2. No adjustment for bad debts

8. Entertaining and gifts

8.1. No deduction for expenses incurred in providing entertaining or gifts

8.2. Exceptions

8.2.1. Gifts or entertainment provided to an employee

8.2.2. Gifts to charity

8.2.3. Gifts or entertainment provided as part of a trade

8.2.4. Gifts < £50 with a 'conspicuous advertisement' for the trade

8.2.4.1. Excluding food, drink, tobacco or vouchers exchangeable for goods

9. Interest

9.1. Accruals basis

9.1.1. Wholly and exclusively rules applies

9.1.2. No relief for interest paid on certain taxes inc. income tax and VAT

9.1.3. No relief for borrowed funds used for non-trade purpose

9.1.3.1. i.e. overdrawn capital account in balance sheet

9.2. Cash basis

9.2.1. Relief for interest paid capped at £500

9.2.2. Wholly and exclusively rules does not apply

9.3. Incidental costs of obtaining loan finance treated in same way as interest paid under the arrangement

10. Motor vehicles

10.1. 2 Options

10.1.1. 1: Claim business use proportion of motor costs

10.1.1.1. Capital allowances, fuel, insurance etc.

10.1.1.2. Usually done by reference to business miles

10.1.2. 2: Claim flat rate deduction based on business miles

10.1.2.1. 45p per mile for the first 10,000 miles

10.1.2.2. 25p per mile there after

10.2. 15% disallowance for cost of leasing a car with CO2 emissions over 50 g/km

11. Penalties

11.1. Case law

11.1.1. No deduction for penalty imposed to punish taxpayer

11.1.2. Penalty arising out of normal trading operations may be allowable

11.2. Legislation

11.2.1. No deduction for penalties charged under certain taxes e.g. VAT surcharge