1. Strategy

1.1. Pricing Committee:

1.1.1. Prep Committee 1 Month Ahead of Offer Request with strategy/statistics

1.1.2. Request Approval of Offer- LTV/Term/rate, etc.

1.2. KICKOFF

1.2.1. Puyallup RV Historical Statistics (results) & Estimated Impact

1.2.2. Set Pre-Screen Criteria (risk)- Marketing & Credit Bureau

1.2.2.1. Lending to Submit Raddon Request to Marketing

1.2.3. Confirm Timeline with stakeholders: vendors, Lending Leadership, Marketing, Service Delivery Leaders, Compliance.

1.2.4. Review NTO's & Did Wells from Previous

1.2.5. Event Plan- Staffing, Materials, Activities?

2. Vendor Managment

2.1. Credit Bureau: TransUnion

2.1.1. Prescreen Job

2.1.1.1. Marketing Pulls Direct Mail/email list per Raddon Request

2.1.1.2. Puyallup RV Lending to QC data file

2.1.1.3. Marketing sends file to Credit Bureau with record count

2.1.1.4. Credit Bureau reviews file & develops OSL & screening Criteria

2.1.1.5. Lending reviews/approves OSL, including completion dates and screening criteria

2.1.1.6. Puyallup RV Credit Bureau sends Final Layout & reports to WSECU; Data file to Mail House

2.1.2. Timeline- 4 weeks to process at TU

2.1.2.1. OSL Delivery?

2.1.2.2. Data file From Credit Bureau to Mail House & Final Reports?

2.2. Mail House: Kaye Smith

2.2.1. Puyallup RV Statement of Work

2.2.1.1. After OSL received from Credit Bureau develop SOW and send to Kaye Smith for estimate and timeline

2.2.2. Timeline- 4 weeks to process from File Delivery by TU

2.2.2.1. Data File from Credit Bureau?

2.2.2.2. Artwork/Envelope/Mailing details?

2.2.2.3. Data proof QC- Delivery & Due Date?

2.2.2.4. Letter Proof QC- Delivery & Due Date?

2.2.3. Message (letter/email)

2.3. Dealership/MHRV

2.3.1. Contracts

2.3.2. Timeline

2.3.3. Marketing/Message

2.3.3.1. Branding- show sponsor, logos, what media tools?

2.3.3.2. Marketing Materials- take ones, giveaways?

2.3.4. Event Management

2.3.4.1. Activities

2.3.4.1.1. Presentation

2.3.4.2. Supplies/booth space

2.3.4.2.1. Responsbilities

2.3.4.3. Scheduling/Access

2.3.4.3.1. Parking

2.3.4.3.2. Event entry/tickets

2.3.4.3.3. Personal belongings/dress code/drawing or giveaway details

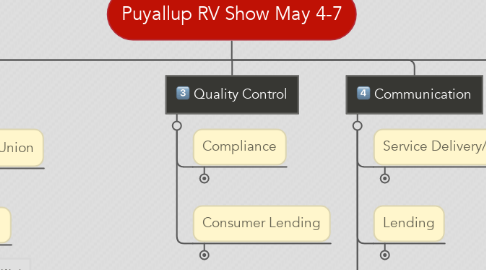

3. Quality Control

3.1. Compliance

3.1.1. Review Strategy/Offer

3.1.2. Review Screening Criteria

3.1.3. Review Message/Disclosure

3.2. Consumer Lending

3.2.1. Offer- Matches Lending Guidelines

3.2.2. Message/Offer Matches Pricing Approval.

4. Communication

4.1. Service Delivery/Contact Center

4.1.1. Message (sample)

4.1.2. Dates/Offer/Contacts (Op Details)

4.1.3. Timeline

4.1.4. Internal Promo (if any)

4.1.5. Event Details

4.1.5.1. Staffing- scheduling/cost

4.1.5.2. Expense Reimbursement

4.1.5.3. Event Duties/Expectations

4.2. Lending

4.2.1. Message (sample)

4.2.2. Dates/Offer/Contacts (Op Details)

4.2.3. Timeline

4.2.4. Internal Promo (if any)

4.2.5. Event Details

4.2.5.1. Staffing- scheduling/cost

4.2.5.2. Expense Reimbursement

4.2.5.3. Event Duties/Expectations

4.3. Compliance

4.3.1. Message (sample)

4.3.2. Timeline

4.4. Marketing

4.4.1. Message (sample)

4.4.2. Dates/Offer/Contacts (Op Details)

4.4.3. Timeline

4.4.4. Event Details

4.4.4.1. Staffing- scheduling/cost

4.4.4.2. Expense Reimbursement

4.4.4.3. Event Duties/Expectations

5. Execution

5.1. Technology

5.1.1. Lending Origination Systems (LPQ/CUDL)

5.1.2. Symitar (Comments/tracking records)

5.1.3. Op Details on SharePoint

5.1.4. Messaging on FEBE

5.2. Mail/Email Drop

5.3. EVENT

5.3.1. Staffing

5.3.2. Materials/Supplies delivered/picked up

5.3.3. Duties/expecations at event

5.3.4. Wrap up- expense reimbursement/payroll

6. Reporting

6.1. Results

6.1.1. 30-60-90 day results

6.2. Performance

6.2.1. Campaign Code reporting