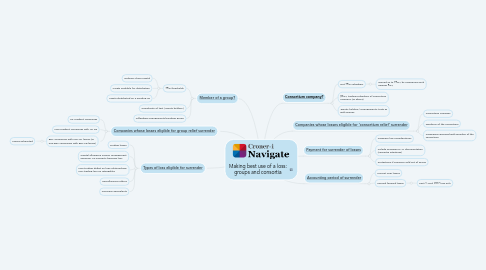

Making best use of a loss: groups and consortia

by Martin Jackson

1. [Member of a group?](https://library.croneri.co.uk/po-heading-id_8QIPRl7QNEqf0K98FkFIHA)

1.1. 75% thresholds

1.1.1. Ordinary share capital

1.1.2. Assets available for distribution

1.1.3. Assets distributed on a winding up

1.2. Complexity of test ('equity holders')

1.3. Offending arrangements breaking group

2. [Types of loss eligible for surrender](https://library.croneri.co.uk/po-heading-id_tLXRQwhfJ06sUIYH5ytnUg)

2.1. Trading losses

2.2. Capital allowance excess; management expense; UK property business loss

2.3. Non-trading deficit on loan relationships; non-trading loss on intangibles

2.4. Miscellaneous others

2.5. Overseas equivalents

3. [Consortium company?](https://library.croneri.co.uk/po-heading-id_OW58gRYD1k2MPn-zEPuWvw)

3.1. Not 75% subsidiary

3.1.1. Owned as to 75%+ by companies each owning 5%+

3.2. 90%+ trading subsidiary of consortium company (as above)

3.3. 'Equity holders'/'arrangements' tests as with groups

4. [Companies whose losses eligible for 'consortium relief' surrender](https://library.croneri.co.uk/po-heading-id_ZMpMwD7C3katId5uZ0_Hww)

4.1. Consortium company

4.2. Members of the consortium

4.3. Companies grouped with member of the consortium

5. [Payment for surrender of losses](https://library.croneri.co.uk/po-heading-id_tLXRQwhfJ06sUIYH5ytnUg)

5.1. Company law considerations

5.2. Include provision in JV documentation (consortia situations)

5.3. Protections if company sold out of group

6. [Accounting period of surrender](https://library.croneri.co.uk/po-heading-id_tLXRQwhfJ06sUIYH5ytnUg)

6.1. Current year losses

6.2. Carried forward losses

6.2.1. Post-1 April 2017 loss only

7. [Companies whose losses eligible for group relief surrender](https://library.croneri.co.uk/po-heading-id_-JZf1EiNzkm7WVs11cdqAA)

7.1. UK resident companies

7.2. Non-resident companies with UK PE

7.3. EEA companies with non-UK losses (or non-EEA companies with EEA PE losses)

7.3.1. Losses exhausted