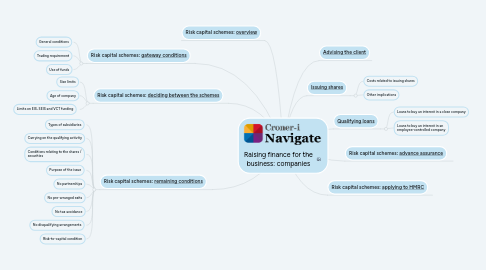

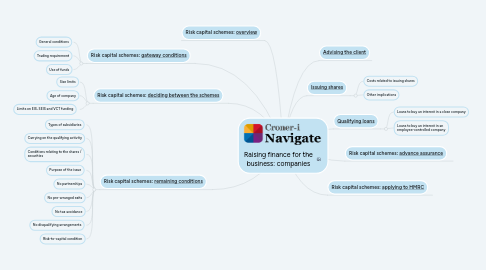

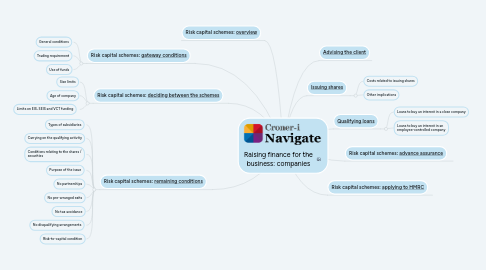

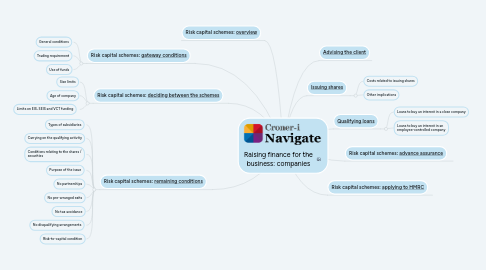

Raising finance for the business: companies

by Lindsey Wicks

1. Risk capital schemes: [remaining conditions](https://library.croneri.co.uk/po-heading-id_3hr1o7-HSkypYR-0_YNwIg)

1.1. Types of subsidiaries

1.2. Carrying on the qualifying activity

1.3. Conditions relating to the shares / securities

1.4. Purpose of the issue

1.5. No partnerships

1.6. No pre-arranged exits

1.7. No tax avoidance

1.8. No disqualifying arrangements

1.9. Risk-to-capital condition

2. Risk capital schemes: [overview](https://library.croneri.co.uk/po-heading-id_qCUBxujMlUOkNfO6p_L22w)

3. Risk capital schemes: [gateway conditions](https://library.croneri.co.uk/po-heading-id_8hRfIPiXsU-HU6rbd8FuyQ)

3.1. General conditions

3.2. Trading requirement

3.3. Use of funds

4. Risk capital schemes: [deciding between the schemes](https://library.croneri.co.uk/po-heading-id_-vFwrE-2PEKHK-AwO7Ps5A)

4.1. Size limits

4.2. Age of company

4.3. Limits on EIS, SEIS and VCT funding

5. Risk capital schemes: [applying to HMRC](https://library.croneri.co.uk/po-heading-id_pcDk8OnGQUey4WkRM3RYxg)

6. Risk capital schemes: [advance assurance](https://library.croneri.co.uk/po-heading-id_FvSrF1b0dkCDWt2phEg65w)

7. [Advising the client](https://library.croneri.co.uk/po-heading-id_rP0Ldm8470WA01ucS1qd6g?section=319261)

8. [Issuing shares](https://library.croneri.co.uk/po-heading-id_nL6yYvrIsUO0mlXNOfhgsg?section=319261)

8.1. Costs related to issuing shares

8.2. Other implications

9. [Qualifying loans](https://library.croneri.co.uk/po-heading-id_jU4NRXGc10md5RTKrCj0Wg)

9.1. Loans to buy an interest in a close company

9.2. Loans to buy an interest in an employee-controlled company