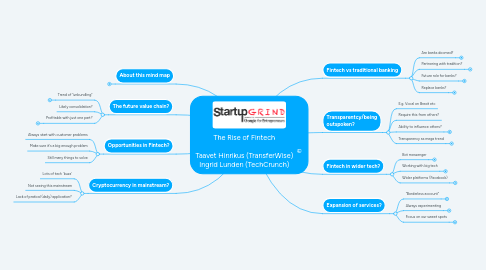

1. About this mind map

1.1. Created by Liam Hughes

1.1.1. Founder: Biggerplate.com

1.1.2. Conference attendee

1.1.3. @BiggerplateLiam

1.2. Shared on Biggerplate.com

1.2.1. Software neutral

1.2.1.1. Don't make/sell software

1.2.1.2. Impartial guidance/advice

1.2.2. Mind Map Library (free)

1.2.3. Mind Map Community (free)

1.2.4. Business Club (nearly free)

1.2.4.1. Webinars & content for business

1.2.4.2. Use code: SGEUROPE17

1.2.4.2.1. Save 50% on first year

1.2.4.2.2. (Normal price: $29/year)

1.3. Created using MindMeister

1.3.1. Collaborative online mapping

1.3.2. Free version available

1.3.3. Vienna & San Francisco

1.3.4. Nice people!

2. The future value chain?

2.1. Trend of "unbundling"

2.1.1. Smaller companies

2.1.1.1. Smaller parts of chain

2.1.1.2. Blend of providers

2.1.2. More fragmented?

2.1.3. But also re-bundling

2.1.3.1. Partnerships

2.2. Likely consolidation?

2.3. Profitable with just one part?

2.3.1. Can be profitable

2.3.2. Can be sustainable

2.3.3. There are big vertical slices

3. Opportunities in Fintech?

3.1. Always start with customer problems

3.2. Make sure it's a big enough problem

3.3. Still many things to solve

4. Cryptocurrency in mainstream?

4.1. Lots of tech 'buzz'

4.2. Not seeing this mainstream

4.3. Lack of pratical (daily) application?

5. Fintech vs traditional banking

5.1. Are banks doomed?

5.1.1. Things will very different

5.1.2. Tech companies

5.1.2.1. Doing 'banking' better than banks

5.1.2.2. Providing better alternatives

5.1.2.3. Challenges

5.1.2.3.1. Building 'trust'

5.2. Partnering with tradition?

5.2.1. Maybe...

5.2.2. Key to this

5.2.2.1. Honesty

5.2.2.1.1. Honest bank

5.2.2.1.2. Honest bankers

5.2.2.2. Customer benefit

5.3. Future role for banks?

5.3.1. Just 'keeping' your money'

5.4. Replace banks?

5.4.1. Probably far-fetched

5.4.2. Different strengths

6. Transparentcy/being outspoken?

6.1. E.g. Vocal on Brexit etc

6.2. Require this from others?

6.3. Ability to influence others?

6.3.1. Transparency is part of the price paid to work with us

6.4. Transparency as mega trend

6.4.1. Customerrs loving this

7. Fintech in wider tech?

7.1. Bot messenger

7.1.1. Good and bad?

7.1.1.1. Platforms are new

7.1.1.2. Be part of the learning

7.1.1.3. Exploring new ideas

7.1.2. Usage/iptake?

7.1.2.1. Not huge

7.1.2.2. But learning lots

7.1.2.3. Largely existing users

7.1.3. Easy to experiment

7.2. Working with big tech

7.2.1. Facebook

7.2.2. Alexa...?

7.2.3. Who drives?

7.2.3.1. Platforms are open

7.2.3.2. Easy for developers to explore

7.3. Wider platforms (Facebook)

7.3.1. What do users want?

7.3.2. Who do users trust?

7.3.2.1. Tech more than banks

7.3.3. Is there a natural fit?

7.3.3.1. Payments in Facebook?

7.3.3.2. We don't know yet

7.3.4. Still early days

8. Expansion of services?

8.1. "Borderless account"

8.1.1. Pain point: international money

8.1.1.1. Transfering

8.1.1.2. Travelling

8.1.2. Solution

8.1.2.1. Balance in 15 currencies

8.1.2.2. Local bank accounts

8.1.2.2.1. In different regions

8.1.2.2.2. Partnerships with local banks

8.1.2.3. Available for everyone

8.2. Always experimenting

8.2.1. What customer problems?

8.2.2. What can we do better?

8.3. Focus on our sweet spots

8.3.1. Play to strengths: Transferring

8.3.2. Keep experimenting

8.3.3. Big niche problem