1. Auditor Appoinment

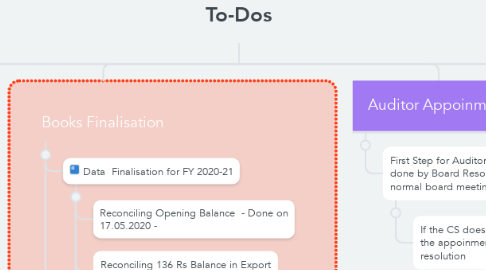

1.1. First Step for Auditor appoinment is to be done by Board Resolution either through normal board meeting or by circulation

1.1.1. If the CS doesnot have any problem then the appoinment can be done by circular resolution

1.1.1.1. Call with Vedaram and Kathir and Cathy tomorrow 21.05.2021 to finetune the anamolies wrt the Earstwile Auditor Appoinment

2. Books Finalisation

2.1. Data Finalisation for FY 2020-21

2.1.1. Reconciling Opening Balance - Done on 17.05.2020 -

2.1.2. Reconciling 136 Rs Balance in Export Fluctuation Account - In Progress

2.1.3. Excel Financial Statements - Preparation

2.1.3.1. Will handover the draft financials to Vedaraman by tomorrow

2.1.4. Excel Disclosure Requirements for FS

2.2. Internal Audit Report Finalisation - Expecting Closure by 18.05.2020

2.2.1. Getting TDS Deduction Clarification on Paypal and AWS from Vedaram

2.2.1.1. TDS Closing Entries being Reconciled Today 19.05.2021

2.3. TDS Filing For FY 2020 - 21 Q4 Salary and NON Salary

2.3.1. Tds Non Salary Has been filed

2.4. Sec 43B Payment Details has been finalised

2.5. Yet to finalise closing Balance of DRS and CRS

2.5.1. - 1. Depreciation. (Assets Finalised ) Today 2. Interest booking for FD and Validation of the FD value in the Books. - Done 3. Consideration in the books for Short term Loans and Advances. 4. Creation of Deferred Tax Assets or Liabilities - Today 5. Verification of Creditor Balances and Debtor Balances 6. Provision for Gratuity - Done

2.5.2. 7. Recon of 26AS Vs Books

3. Current Books

3.1. The Payment and the Bill Booking are done for April 2021

3.2. Yet to Post the Sales Data Will get over by 19.05.2021

3.3. e

4. GST REFUND

4.1. GST Application Filed on 07.05.2021

4.2. Pending With the Authority

4.2.1. Task Not yet Allotted to any Staff

4.2.1.1. Spoke with GST Supertindent and Inspector we came to know that the Supertindent mathi has carona and admitted to hospital condition not serious.

4.2.1.1.1. Got a way to manually give the additional docs to email to [email protected]

4.3. Now the dept has provisionally sanctioned 34 Lakhs instead of 35 Lakhs

4.3.1. We met the inspector Suresh in this regard Today 19.05.2021

4.3.1.1. He has initiated 34 Lakhs

4.3.1.1.1. Now we have to get in touch with Ac To get the refund first 80 % then Balance

4.4. Old GST Hold of 65000 Not recredited to the ECL we have to follow on this case too

5. Fema Compliance

5.1. Sridhar Reply for Available Docs Received

5.1.1. Call with Sridhar has been Planned with Kathir

5.1.1.1. Call done with Sridhar

5.1.1.1.1. Yet to consolidate the Points for the Board Meeting .