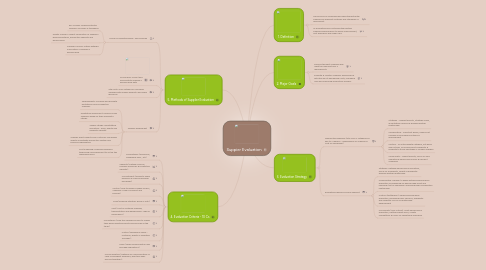

1. 4. Evaluation Criteria - 10 Cs

1.1. Competency (Workforce, Managerial skills , etc)

1.2. Capacity (Material sources, Machine resources & Production capacity)

1.3. Commitment (Willing to share problems & Improve working processes)

1.4. Control (How to handle sudden issues?, Suppliers' code of conduct and policies)

1.5. Cash (Financial situation: good or not?)

1.6. Cost (Cost of materials supplied, transportation and warehousing - high or reasonable?)

1.7. Consistency (How the suppliers ensure to supply their good-quality products and services all the time?)

1.8. Culture (Workplace values - customer, quality or operation focused?)

1.9. Clean (Obey environmental rules and legal regulations)

1.10. Communication (Methods of communication; in case of emergent problems, how two sides discuss together?)

2. 5. Methods of Supplier Evaluation

2.1. Surveys & Questionnaires- Well-planned

2.1.1. RFI Surveys: Qualify potential suppliers via email or telephone

2.1.2. Quality Surveys: Collect information of supplier's planning systems, production capacity and performance

2.1.3. Supplier Surveys: Gather detailed information of supplier's performance

2.2. Scorecards: Collect and Demonstrate supplier's performance data

2.3. Site visits: Only suitable for monopoly suppliers with unique products and scare resources

2.4. Supplier assessment

2.4.1. Spreadsheets: Compare and Evaluate quotations from prospective suppliers

2.4.2. Qualitative assessment: Measure close suppliers based on their specialists' ratings

2.4.3. Vendor ratings: Quantitative evaluation - price, quality and reliability capacity

2.4.4. Supplier audit: Experts from customer companies directly investigate production system and business organization

2.4.5. Cost modelling: Analysing suppliers' technology and equipment to set up the reasonable price

3. 1. Definition

3.1. The process of measuring and selecting potential suppliers by different methods and standards of assessment

3.2. Or evaluating and controlling the existing suppliers performance to achive improvement, cost efficiency and lower risks.

4. 2. Major Goals

4.1. Possess the best suppliers who meet the manufacturer 's requirements

4.2. Evaluate & Monitor suppliers' performance with the aim at decreasing costs, managing risks and improving production process

5. 3. Evaluation Strategy

5.1. Segmenting suppliers (into main 4 categories & due to 2 reasons - Dependence on Supplier & Cost of Ownership)

5.1.1. Strategic - Highest priority, Strategic value, Quantilative measure & Building partner relationship

5.1.2. Collaborative - Important group, High profit margins & Encourage continuous improvement

5.1.3. Custom - An intermediate category, not good and not bad , Ensure product availability & reliability to avoid shortages or sudden changes

5.1.4. Commodity - Lowest priority, Focus on only operational performance basis & efficient supplying

5.2. Evaluating suppliers in each segment

5.2.1. Strategic: Detailed performance evaluation, Focus on Availability, Quality & Reliability; Develop partner relationship

5.2.2. Collaborative: Medium to highly detailed performance evaluation, Emphasizing on gaining high profit and reducing cost of ownership. Improving high-coordination relationship

5.2.3. Custom (Bottleneck): General performance evaluation, Qualifying basic services, availability and reliability; Focus on relationship development

5.2.4. Commodity (Non-critical): Least performance evaluation, Getting lowest price, Create competition & Focus on operational efficiency