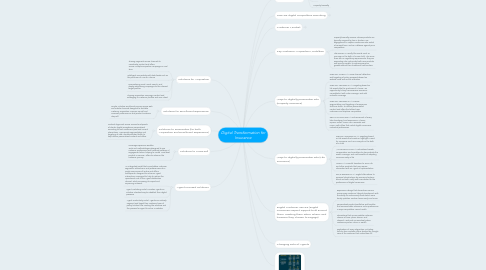

1. Solutions for Acquisition

1.1. Sharing segments across channels to coordinate content and offers across multiple acquisition campaigns in real time

1.2. Intelligent connectivity with data feeds such as the purchase of a car or a home

1.3. Personalizing social, email, search, and display advertising campaigns to the relevant target profiles

1.4. Aligning acquisition campaign content and messaging to customer profiles and user intent

2. Solutions for Enrollment Experience

2.1. Simple, intuitive enrollment process across web and mobile channels designed to facilitate customer acquisition, improve up-sell and cross-sell performance, and prevent customer drop-off.

3. Solutions to Personalize (for both Acquisition and Enrollment Experience)

3.1. Content alignment across various touchpoints of clients’ digital ecosystems, personalized according to each customer’s past and current interactions. Appropriate segmentation and targeting of new, unauthenticated traffic to help deliver personalized content and offers.

4. Solutions to Cross-sell

4.1. Coverage Expansion Enabler Tools and methodologies designed to use customer preferences and historical patterns of engagement when helping to create “next best product or service” offers to advance the customer journey

5. Agent Focused Solutions

5.1. An integrated portal that consolidates customer segments, interactions, and preferences into a single view across all online and offline touchpoints, designed to enhance Agent interactions. Designed to help to reduce the operational cost of the Agent distribution channel, while increasing its impact and improving outreach.

5.2. Agent Marketing Portal: Provides Agents an intuitive, standard way to establish their digital presence

5.3. Agent Productivity Portal: Agents can actively segment and target their customer base of policy holders thus creating the interface and the process for agent to act as a marketer

6. Insurance segments

6.1. Auto

6.2. Life

6.3. Property/Casualty

7. How are digital competitors executing

7.1. Delivering engaging brand experiences across multiple digital channels

7.2. Creating online-only brands to compete with established offerings

7.3. Using direct models to neutralize the value of incumbents’ Agent networks

7.4. Using connected devices to streamline processes and improve the experience. Deploying real-time “name your own” price and coverage comparators

7.5. Offering paperless transactions throughout the entire relationship

7.6. Encouraging side-by-side comparisons that focus consumers on price

7.7. Reducing barriers and raising incentives to switch to their products

7.8. Digitizing service interactions for mid-market audiences and products

7.9. Building partner ecosystems to offer valued but nontraditional services

7.10. Expanding loyalty programs to offer value, not just discounts

8. Customer Mindset

8.1. No loyalty

8.1.1. Among property/casualty customers, only 22% feel any loyalty to their provider

8.1.2. 30% of property/casualty customers would consider shopping for a better deal

8.1.3. Price sensitive = 38% of life insurance customers evaluate new providers based on price

8.1.4. 34% of life insurance customers switched providers in the last year

8.2. Digital

8.2.1. Where Boomer and Gen-X customers expected prompt, courteous service delivered in person, Millennials expect its digital equivalent. They measure insurance against their best experiences with digital standouts like Amazon®, Spotify®, and Uber®. They expect interactions personalized to their attributes, behavior, and intent, continuous across every device and platform and every step of their customer journey—as they choose to define it.