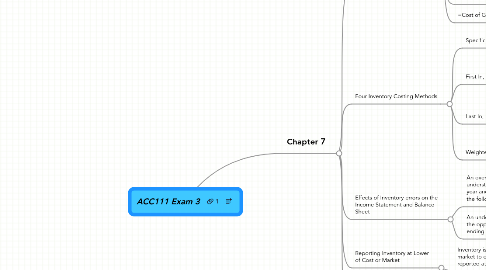

1. Chapter 7

1.1. Cost of Goods Sold Equation

1.1.1. Beginning Inventory

1.1.2. +Purchases of merchandise made during the year

1.1.3. =Goods available for sale

1.1.4. -Ending Inventory

1.1.5. =Cost of Goods Sold

1.2. Four Inventory Costing Methods

1.2.1. Specific Identification Method

1.2.1.1. Assigns costs to ending inventory and the cost of goods sold by identifying and tracking specific inventory items

1.2.2. First In, First Out (FIFO) Method

1.2.2.1. assigns the costs of the goods first in to the cost of goods sold and the costs of the goods last in (the most recent) to the ending inventory

1.2.3. Last In, First Out (LIFO) Method

1.2.3.1. assigns the costs of the goods last in to the cost of goods sold and the costs of the goods first in (the oldest) to the ending inventory

1.2.4. Weighted Average Method

1.2.4.1. assigns the weighted average cost per unit of inventory to both the cost of goods sold and the ending inventory

1.3. Effects of Inventory errors on the Income Statement and Balance Sheet

1.3.1. An overstatement of ending inventory results in an understatement of the cost of goods sold in the current year and an overstatement of the cost of goods sold in the following year

1.3.2. An understatement of ending inventory has the opposite effects of overstating the ending inventory

1.4. Reporting Inventory at Lower of Cost or Market

1.4.1. Inventory is stated at lower of cost or market to ensure that they are not reported at more than they're worth

1.5. Inventory Turnover Ratio

1.5.1. The inventory turnover ratio is calculated by dividing the cost of goods sold by average inventory. It indicates how many times average inventory was acquired and sold during the period and reflects the efficiency of inventory management

1.5.1.1. Cost of Goods Sold

1.5.1.2. ÷Average Inventory

1.5.2. Days to sell is computed by dividing 365 by the inventory turnover ratio. It indicates the average number of days from purchase to sale

1.5.2.1. 365

1.5.2.2. ÷Inventory Turnover Ratio