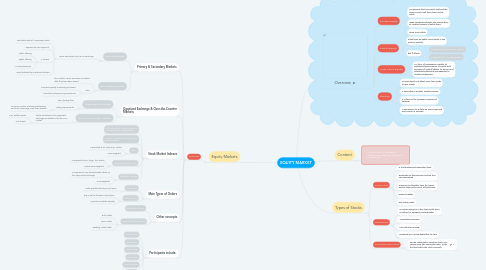

1. Equity Markets

1.1. Participants

1.1.1. Primary & Secondary Markets

1.1.1.1. Primary market

1.1.1.1.1. issues new stocks (IPO) on an exchange

1.1.1.2. Secondary markets

1.1.1.2.1. the market in which securities are traded after they have been issued.

1.1.1.2.2. Role

1.1.2. Oganized Exchange & Over-the-Counter Markets

1.1.2.1. Organized exchange

1.1.2.1.1. has a trading floor

1.1.2.1.2. Listing requirements

1.1.2.2. Over-the-Counter Markets

1.1.2.2.1. Stocks not listed on the Organized exchange are traded in the the OTC market

1.1.3. Stock Market Indexes

1.1.3.1. is the composite value of a group of secondary market-traded stocks.

1.1.3.2. are used to monitor the behavior of a groups of stocks

1.1.3.3. ODJIA

1.1.3.3.1. Composed of 30 "blue-chip" stocks

1.1.3.3.2. Price weighted

1.1.3.4. S&P 500 Composite Index

1.1.3.4.1. Composed of 500 "large" firm stocks

1.1.3.4.2. Market value weighted

1.1.3.5. Nikkei 225 Average

1.1.3.5.1. Composed of 225 actively-traded stocks on the Tokyo Stock exchange

1.1.3.5.2. Price weighted

1.1.4. Main Types of Orders

1.1.4.1. Limit Orders

1.1.4.1.1. Order specifies the buy or sell price

1.1.4.2. Market Orders

1.1.4.2.1. buy or sell at the best current price

1.1.4.2.2. provide immediate liquidity

1.1.5. Other concepts

1.1.5.1. Short sales of stocks

1.1.5.2. General market conditions

1.1.5.2.1. Bull market

1.1.5.2.2. Bear market

1.1.5.2.3. Reading a Stock table

1.1.6. Participants include:

1.1.6.1. Stock investor

1.1.6.2. Stock traders

1.1.6.3. Market Maker

1.1.6.4. Floor Trader

1.1.6.5. Floor/Pit Broker

1.1.6.6. Broker-Dealer

2. Content

2.1. Is a public entity for the trading of company stock (shares) and derivatives at an agreed price.

3. Overview

3.1. Private Equity

3.1.1. Is a business that is privately held and the owners cannot sell their shares to the public

3.1.2. make investment directly into private firms or conduct buyouts of public firms

3.1.3. Hope to go public

3.2. Public Equity

3.2.1. when firms go public, issue stocks in the primary markets

3.2.2. has 2 effects

3.2.2.1. changes the firm's ownership structure

3.2.2.2. changes the firm 's capital structure

3.3. Joint Stock Equity

3.3.1. Is a form of organization capable of mobilizing larger amount of capital with provision of limited liability for owners and affording professional management to conduct its business

3.4. Stocks?

3.4.1. At some point, just about every firm needs to raise money

3.4.2. Is ownership in a public traded company

3.4.3. Is a claim on the company's assets and earnings.

3.4.4. A part owner has a claim on every asset and every penny in earnings.

4. Types of Stocks

4.1. Common stock

4.1.1. is the fundamental ownership claim

4.1.2. Dividends are discretionary and are thus not guaranteed

4.1.3. Common stockholders have the lowest priority claim in the event of bankruptcy

4.1.4. Limited Liability

4.1.5. Has voting rights

4.2. Preferred Stock

4.2.1. an equity interest in a firm that usually does not allow for signigicant voting rights

4.2.2. Acumulative provision

4.2.3. Less risk when issuing

4.2.4. Dividends are not tax-deductible for firm

4.3. Convertible Preferred Stock

4.3.1. Can be converted to common shares at a certain price (the conversion ratio, set by the firm before the stock is issued).