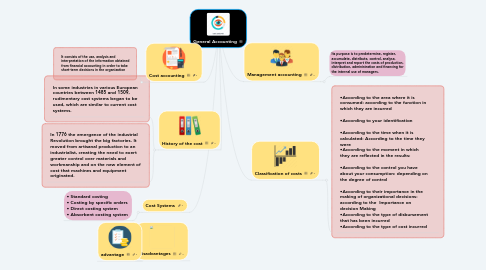

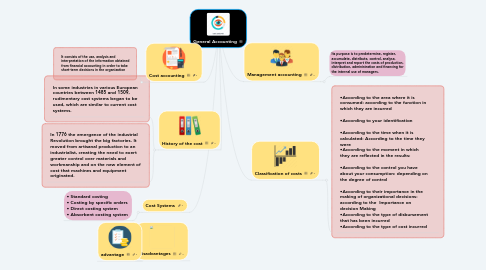

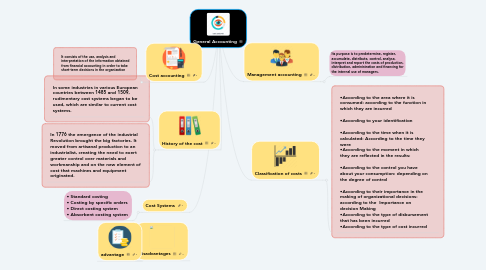

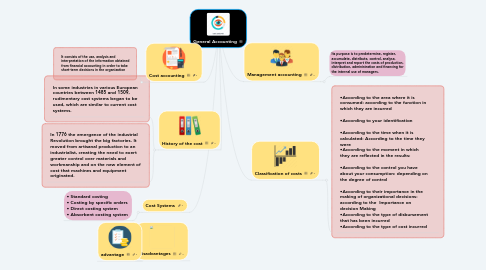

General Accounting

by Alejandra rios

1. disadvantages

2. advantage

3. Cost accounting

3.1. It consists of the use, analysis and interpretation of the information obtained from financial accounting in order to take short-term decisions in the organization

4. History of the cost

4.1. In some industries in various European countries between 1485 and 1509, rudimentary cost systems began to be used, which are similar to current cost systems.

4.2. In 1776 the emergence of the industrial Revolution brought the big factories. It moved from artisanal production to an industrialist, creating the need to exert greater control over materials and workmanship and on the new element of cost that machines and equipment originated.

5. Cost Systems

5.1. • Standard costing • Costing by specific orders • Direct costing system • Absorbent costing system

6. Management accounting

6.1. Its purpose is to predetermine, register, accumulate, distribute, control, analyse, interpret and report the costs of production, distribution, administration and financing for the internal use of managers.

7. Classification of costs

7.1. •According to the area where it is consumed: according to the function in which they are incurred •According to your identification •According to the time when it is calculated: According to the time they were •According to the moment in which they are reflected in the results: •According to the control you have about your consumption: depending on the degree of control •According to their importance in the making of organizational decisions: according to the Importance on decision Making •According to the type of disbursement that has been incurred •According to the type of cost incurred