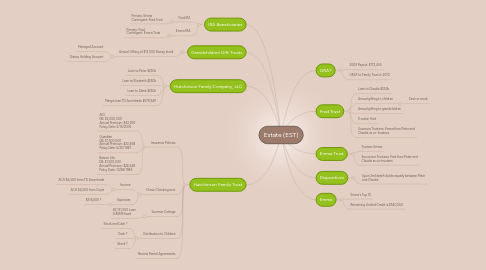

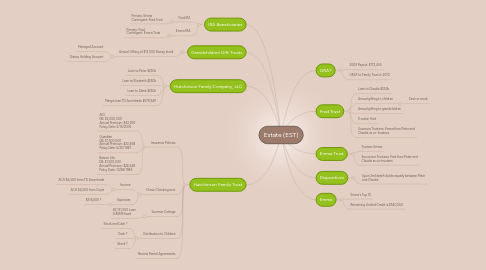

Estate (EST)

by Dan Taylor

1. IRA Beneficiaries

1.1. Fred IRA

1.1.1. Primary: Emma Contingent: Fred Trust

1.2. Emma IRA

1.2.1. Primary: Fred Contingent: Emma Trust

2. Grandchildren Gift Trusts

2.1. Annual Gifting of $13,000 Disney stock

2.1.1. Managed Account

2.1.2. Disney Holding Account

3. Hutchinson Family Company, LLC

3.1. Loan to Peter $250k

3.2. Loan to Elizabeth $250k

3.3. Loan to Diana $250k

3.4. Margin loan TD Ameritrade $576,549

4. Hutchinson Family Trust

4.1. Insurance Policies

4.1.1. AIG DB: $2,000,000 Annual Premium: $42,250 Policy Date: 2/15/2006

4.1.2. Guardian DB: $1,500,000 Annual Premium: $22,458 Policy Date: 6/20/1987

4.1.3. Banner Life DB: $1,500,000 Annual Premium: $24,548 Policy Date: 12/28/1983

4.2. Chase Checking acct

4.2.1. Income

4.2.1.1. ACH $4,500 from TD Ameritrade

4.2.1.2. ACH $4,500 from Coyle

4.2.2. Expenses

4.2.2.1. $216,000 ?

4.3. Summer Cottage

4.3.1. $2,151,000 Loan 6.825% fixed

4.4. Distribution to Children

4.4.1. Stock and Cash ?

4.4.2. Cash ?

4.4.3. Stock ?

4.5. Review Rental Agreements

5. GRAT

5.1. 2009 Payout: $172,455

5.2. GRAT to Family Trust in 2010

6. Fred Trust

6.1. Loan to Claudia $250k

6.2. Annual gifting to children

6.2.1. Cash or stock