Economics Unit 3

by james campbell

1. Profit maximisation

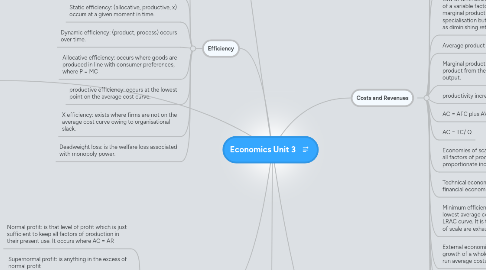

1.1. Normal profit: is that level of profit which is just sufficient to keep all factors of production in their present use. It occurs where AC = AR

1.2. Supernormal profit: is anything in the excess of normal profit

1.3. Profits are maximised where MC = MR

1.4. Role of profit: allocation of factors of production, signal for market entry, promotes innovation, investment, rewards risk, economic performance indicator.

1.5. Goals: managerial status, market share, revenue maximisation.

1.6. Prinicipal agent problem exists due to existence of asymmetric information

2. Perfect competition

2.1. Assumptions: many buyers and sellers, no barriers to entry or exit, identical products, perfect information, no externalities, no economies of scale.

2.2. Sunk costs: are these costs that cannot be recovered e.g. training, advertising.

2.2.1. New node

2.3. Short run shutdown: p< AVC

2.4. Long run shutdown: p< AC

2.5. The long run: is that period of time where all factors are variable implying that new firms are able to enter the industry.

2.6. Non price competitive factors: brand, quality, delivery times, location, differentiation, innovation, range, customer service.

2.7. Benefits: lower prices, low barriers to entry, lower total profits, economic efficiency.

3. Efficiency

3.1. Consumer surplus: is the difference between the price the consumer is prepared to pay and the price they actually pay.

3.2. Producer surplus: is the difference between the price at which the producer is prepared to supply and the price they actually recieve.

3.3. Static efficiency: (allocative, productive, x) occurs at a given moment in time.

3.4. Dynamic efficiency: (product, process) occurs over time.

3.5. Allocative efficiency: occurs where goods are produced in line with consumer preferences, where P = MC

3.6. productive efficiency: occurs at the lowest point on the average cost curve.

3.7. X efficiency: exists where firms are not on the average cost curve owing to organisational slack.

3.8. Deadweight loss: is the welfare loss associated with monopoly power.

4. Concentrated markets

4.1. Concentration ratio: is the value of output from the largest firms in the industry.

4.2. Desire to grow: market power, managers objective, profit motive, economies of scale, risk.

4.3. Internal growth: uses retained profits or loans to finance expansion by increasing fixed and variable factors.

4.4. External growth: is expansion through acquisitions and mergers.

4.5. Horizontal merger: occurs when two businesses in the same industry at the same stage of production become one.

4.6. Vertical integration: acquiring a business in the same industry but at different stages of the supply chain.

4.7. Lateral merger: merger between companies that are related but not identical

4.8. Conglomerate merger: merger between firms in unrelated business.

5. Monopoly

5.1. Exists where there is only one firm in the industry, which has a greater than 25% of market share.

5.2. Barriers to entry are to block potential entrants to protect supernormal profits and market power: high fixed costs, economies of scale, brand loyalty, legal barriers, factor of production control, control over retailers, predatory pricing.

5.3. Strategic entry: hostile takeovers, brand proliferation, capacity expansion, predatory pricing.

5.4. Costs of a monopoly: huge supernormal profits, loss of allocative, productive and x efficiency, reduced consumer surplus

5.5. Benefits: economies of scale, natural monopoly reaches MES, dynamic efficiency.

6. Costs and Revenues

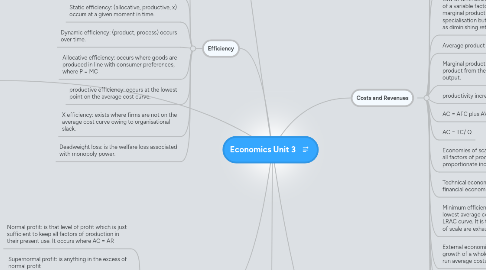

6.1. Fixed costs: is one that does not change with output e.g. rent, property taxes, loan payments.

6.2. Variable costs: are costs that changes with output. e.g. components

6.3. TC = FC plus VC

6.4. AC = TC/ Q

6.5. Fixed costs are diluted as production increases.

6.6. Short run: is that period of time where at least one factor of production is fixed, usually capital.

6.7. Law of diminishing returns: states that as more of a variable factor is added to a fixed factor marginal product will initially rise owing to specialisation but marginal production will fall as diminishing returns set in.

6.8. Average product is output per worker

6.9. Marginal product: is the addition to total product from the production of one extra unit of output.

6.10. productivity increase - decrease cost per unit

6.11. AC = AFC plus AVC

6.12. AC = TC/ Q

6.13. Economies of scale: exist where an increase in all factors of production lead to a more than proportionate increase in output.

6.14. Technical economies of scale, financial economies of scale

6.15. Minimum efficient scale: is the point where the lowest average cost is first reached on the LRAC curve. It is the point where all economies of scale are exhausted.

6.16. External economies of scale exist when the growth of a whole industry lead to a falling long run average costs.

6.17. TR = P times Q

6.17.1. New node