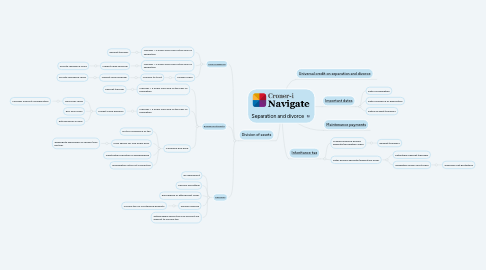

1. Division of assets

1.1. [Main residence](https://library.croneri.co.uk/po-heading-id_vg8geWuwXkGYKkQtT7yXeQ)

1.1.1. Transfer < 3 years from end of tax year of separation

1.1.1.1. Exempt transfer

1.1.2. Transfer > 3 years from end of tax year of separation

1.1.2.1. Market value disposal

1.1.2.1.1. Private residence relief

1.1.3. Mesher order

1.1.3.1. Transfer to trust

1.1.3.1.1. Market value disposal

1.2. [Business interests](https://library.croneri.co.uk/po-heading-id_uq7ASeyr5EmhabAgux9vyA)

1.2.1. Transfer < 3 years from end of tax year of separation

1.2.1.1. Exempt transfer

1.2.2. Transfer > 3 years from end of tax year of separation

1.2.2.1. Market value disposal

1.2.2.1.1. Hold over relief

1.2.2.1.2. Roll over relief

1.2.2.1.3. Entrepreneur's relief

1.2.3. Company buy back

1.2.3.1. Not for avoidance of tax

1.2.3.2. Held shares for five years prior

1.2.3.2.1. Aggregate ownership of spouse/civil partner

1.2.3.3. Substantial reduction in shareholding

1.2.3.4. Immediately after not connected

1.3. [Pensions](https://library.croneri.co.uk/po-heading-id_4VWgP2Tgjkml4IFb4WGrhw)

1.3.1. By agreement

1.3.2. Pension offsetting

1.3.3. Earmarking or attachment order

1.3.4. Pension sharing

1.3.4.1. Income tax on crystallised benefits

1.3.5. Withdrawals above tax free amount are subject to income tax

2. [Important dates](https://library.croneri.co.uk/po-heading-id_i5oxlfE4D0-lVdDBI4uKbA)

2.1. Date of separation

2.2. Date of divorce or dissolution

2.3. Dates of asset transfers

3. [Inheritance tax](https://library.croneri.co.uk/po-heading-id_JRsfhlsAe0qzvKGBKwU-tw)

3.1. Transfers before decree absolute/dissolution order

3.1.1. Exempt transfers

3.2. After decree absolute/dissolution order

3.2.1. Potentially exempt transfers

3.2.2. Obligation under court order

3.2.2.1. Generally not gratuitous