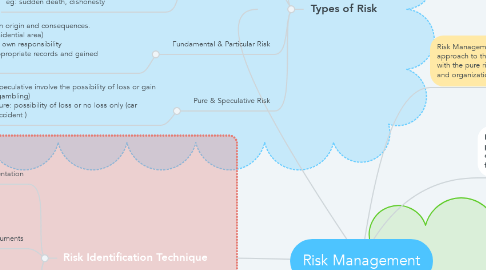

1. Types of Risk

1.1. Financial & Non Financial Risk

1.1.1. Financial: Market, Credit, Liquidity, Interest Rate Non Financial: Implementation, Operational, Reputation

1.2. Static & Dynamic Risk

1.2.1. Static:: Changes of Economic eg: changes in price levels, consumer taste, income, and output Dynamic: exist even in the absence of economic change eg: sudden death, dishonesty

1.3. Fundamental & Particular Risk

1.3.1. Fundamental (societal) : impersonal in origin and consequences. (unemployment, build factory in a residential area) Particular: considered the individual’s own responsibility eg:-Daylight robbery/fraudster misappropriate records and gained money/benefit

1.4. Pure & Speculative Risk

1.4.1. Speculative involve the possibility of loss or gain (gambling) Pure: possibility of loss or no loss only (car accident )

1.4.1.1. Types of Pure Risk: Personal, Property, Liability & Risks arising out of failure of others

2. Risk Identification Technique

2.1. 1) Orientation

2.1.1. Understand the knowledge of the company

2.1.2. Deductive Approach

2.2. 2) Documents

2.2.1. Financial Statement Analysis

2.2.2. SOP Flowchart

2.2.3. Annual Report

2.3. 3) Interviews

2.3.1. External Parties

2.3.2. Employees & Supervisor

2.4. 4) Inspection

2.4.1. Examination of various operation sites

2.4.2. Discussion with managers and workers

3. Risk Management Process

3.1. 1. Determination of objectives

3.2. 2. Identification of risks

3.3. 3. Evaluation of risks

3.3.1. Critical - severe financial impact

3.3.2. Important - Moderate financial impact

3.3.3. Unimportant - Modest financial impact

3.4. 4. Consideration of alternatives - selection of the tool

3.5. 5. Implementing the decision

3.6. Evaluation and review

4. Risk Management: a scientific approach to the problem of dealing with the pure risks facing individuals and organizations.

5. Risk Management Tools

5.1. Risk Control: aimed at reducing the number of risks facing the organization or the amount of loss that can arise from these exposures

5.1.1. Avoidance : takes place when decisions are made that prevent a risk even coming into existence.

5.1.2. Reduction : to define a broad set of efforts aimed at minimizing risk

5.2. Risk Financing: techniques designed to guarantee the availability of funds to meet those losses that do occur

5.2.1. Retention : "residual" or "default" risk management.

5.2.1.1. Intentional/Unintentional

5.2.1.2. Voluntary/Involuntary Retention

5.2.1.3. Funded/Unfunded

5.2.2. Transfer : accomplished in a variety of ways

5.2.2.1. Purchase of Insurance

5.2.2.2. Hedging

5.2.2.3. Hold harmless agreement

5.2.2.4. Subcontracting

5.2.2.5. Surety bonds