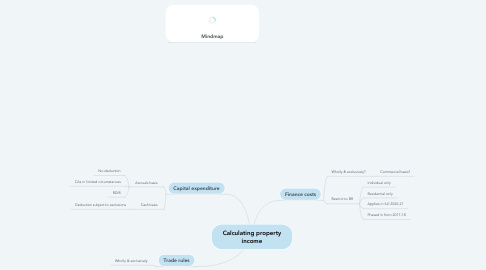

Calculating property income

by Stephen Relf

1. Capital expenditure

1.1. Accruals basis

1.1.1. No deduction

1.1.2. CAs in limited circumstances

1.1.3. RDIR

1.2. Cash basis

1.2.1. Deduction subject to exclusions

2. Trade rules

2.1. Wholly & exclusively

3. Mindmap

4. Finance costs

4.1. Wholly & exclusively?

4.1.1. Commercial basis?

4.2. Restrict to BR

4.2.1. Individual only

4.2.2. Residential only

4.2.3. Applies in full 2020-21

4.2.4. Phased in from 2017-18