1. Principles

1.1. Supported by Islamic Bankings Core Values whereby cultivate entrepreneurship, trade and commerce

1.2. Interest , gambling and speculative trading are prohibited

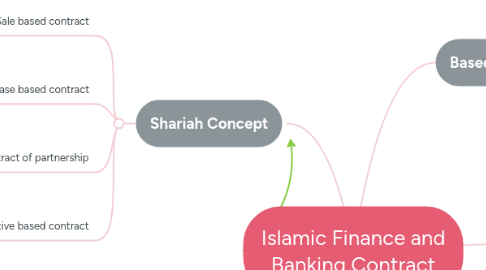

2. Shariah Concept

2.1. Sale based contract

2.1.1. Salam

2.1.2. Istisna'

2.2. Lease based contract

2.2.1. Ijarah

2.2.2. Ijarah thumma al-bai'

2.3. Contract of partnership

2.3.1. Musyarakah

2.3.2. Mudharabah

2.4. Supportive based contract

2.4.1. Ar-rahnu

2.4.2. Kafalah

3. Foundation of Shariah

3.1. Belief

3.2. God Consciousness

3.3. Knowledge

3.4. Sincerity

3.5. Human Being

3.6. Source of Law

4. Introduction

4.1. Complies with Islamic Law (Shariah Law)

4.2. Mutual risk and profit sharing between parties

5. Contract (Akad)

5.1. Symbol of willingness between parties that involved

5.2. Ijab and Qabul

5.2.1. An endeavor of bonding an agreement

5.2.2. Clarify and produce willingness between both party who is in contract and knowing its implication.

6. Formalities of Contract

6.1. Offer (Ijab)

6.1.1. Modes of Offer

6.1.2. Tense of Offer

6.1.3. Counter Offer

6.1.4. Revocation of Offer

6.1.5. Termination of Offer

6.2. Acceptance (Qabul)

6.2.1. Modes of Acceptance

6.2.2. Tense of Acceptance

6.2.3. Communication of Acceptance

7. Based on Al-Quran

7.1. Al-Baqarah : 282

7.1.1. All transaction between debtors and creditors must be written down.

7.1.2. Must have a guardian due to

7.1.2.1. debtors cannot manage the financial

7.1.2.2. if the debtors is underage

7.1.2.3. lack of education and experience

7.1.3. Must have witness

7.1.3.1. 2 mens

7.1.3.2. 1 men and 2 woman