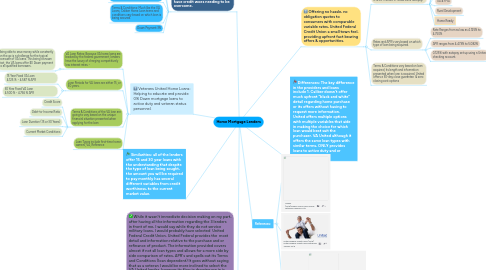

1. Veterans United Home Loans: Helping to educate and provide 0% Down mortgage loans to active duty and veteran status personnel.

1.1. VA Loan Rates: Because VA home loans are backed by the federal government, lenders have the luxury of charging competitively low interest rates. -

1.1.1. Being able to save money while constantly on the go is a challenge for the typical borrower of VA loans. This being a known fact, the VA loans offer $0 Down payment to all qualified borrowers.

1.2. Loan Periods for VA loans are either 15, or 30 years.

1.2.1. 15 Year Fixed VA Loan 4.125 % - 4.587 % APR

1.2.2. 30 Year Fixed VA Loan 4.500 % - 4.766 % APR

1.3. Terms & Conditions of the VA loan are going to vary based on the unique financial situation presented when applying for the loan

1.3.1. Credit Score

1.3.2. Debt-to-Income Ratio

1.3.3. Loan Duration (15 or 30 Years)

1.3.4. Current Market Conditions

1.4. Loan Types include first-time home owners, VA, Refinance

2. Caliber Home Loans: Ideal for first-time home buyers, veterans, and anyone who may have credit woes needing to be overcome.

2.1. Loan types Caliber Home Loan handles include Purchase, Refinance, Jumbo, Fixed, Adjustable, FHA, VA, USDA

2.2. Loan periods include 15 and 30 year loans

2.3. Rates were not made readily available upon visiting the site, but invites you to request information.

2.4. Terms & Conditions: Much like the VA Loans, Caliber Home Loan terms and conditions vary based on which loan is being secured.

2.5. Down Payment 3%

3. Similarities: all of the lenders offer 15 and 30 year loans with the understanding that despite the type of loan being sought, the amount you will be required to pay monthly has several different variables from credit worthiness, to the current market value.

4. While it wasn't immediate decision making on my part, after having all the information regarding the 3 lenders in front of me, I would say while they do not service military loans, I would probably have selected United Federal Credit Union. United Federal provides the most detail and information relative to the purchase and or refinance of product. The information provided covers almost if not all loan types and allows for a more side by side comparison of rates, APR's and spells out its Terms and Conditions (loan dependent) It goes without saying that as a veteran I would be more inclined to select the VA United lender, however its flaw in drawing me in is that there shows very little room for movement. I like that viewing United Federal information empowers me to make a decision on my own given the facts if I want to pursue a loan with them. The options to get a better handle on what is offered before having a conversation with what is assumed understanding of the terminology. UFCU for the win.

5. Offering no hassle, no obligation quotes to consumers with comparable variable rates, United Federal Credit Union a small town feel, providing upfront fact bearing offers & opportunities.

5.1. United mortgage loans offered fixed and Conforming (ALL offered an additional 0.125% if utilize in house bank autopay)

5.1.1. Fixed & Adjustable

5.1.2. Construction & Lot

5.1.3. Jumbo

5.1.4. VA & FHA

5.1.5. Rural Development

5.1.6. Home Ready

5.2. Rates and APR's vary based on which type of loan being acquired.

5.2.1. Rate Ranges from as low as 4.125% to 4.750%

5.2.2. APR ranges from 4.473% to 5.082%

5.2.3. 0.125% with autopay set up using a United checking account.