1. Perfect competition

1.1. Conditions

1.1.1. No barriers to entry

1.1.2. Identical products

1.1.3. Perfect information

1.1.4. Many buyers / sellers

1.1.5. No EoS or externalities

1.2. e.g. FOREX, sugar, FCOJ etc

1.3. No supernormal profit made in long run

1.4. Imperfectly competitive markets differentiate on brand, quality, design, customer support etc

2. Efficiency, consumer / producer surplus

2.1. CS - difference between what willing to pay and price

2.2. PS - difference what willing to sell for and price

2.3. Types of efficiency

2.3.1. Dynamic

2.3.1.1. Product innovation, e.g. changing to digital downloads

2.3.1.2. Process innovation, e.g. using robots in iPhone production

2.3.2. Static

2.3.2.1. Productive, bottom of AC = acting on PPF boundary

2.3.2.2. Allocative, SS = DD

2.3.2.3. X inefficiency, organisational slack

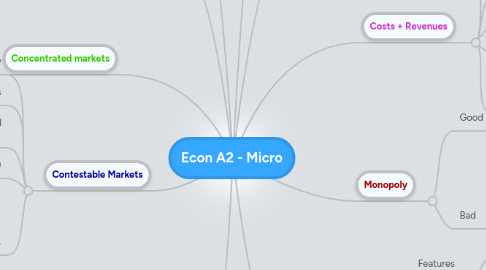

3. Concentrated markets

3.1. Firms are like water - more = less concentrated

3.2. % of market share held by top (e.g. 5) firms

3.3. High suggests monopolistic powers

4. Contestable Markets

4.1. Low barriers to entry

4.2. All firms have same cost curves

4.3. Threat of a new firm ensures supernormal profit is non existent

4.4. Zero sunk costs (fixed costs)

4.5. Encouraged by..

4.5.1. Deregulation

4.5.2. Competition policy

4.5.3. New technology

4.5.4. EU single market

5. Market Structure & Technology

5.1. Innovation

5.1.1. UK goods become more competitive

5.1.2. Compete with emerging economies - China

5.1.3. More jobs as more training needed + different industries - technology

5.1.4. New health + better transport. Social reasons

5.2. Price makers - monopoly, leader in oligolpoly

5.3. Price takers - perfect competition

5.4. Technology

5.4.1. LRAC moves down

5.4.2. High fixed costs, but soon pay for themselves

5.4.3. Increase consumption as SS moves out

5.4.4. Reduces barriers to entry - Amazon

6. Costs + Revenues

6.1. MC meets AC at lowest point of AC

6.2. DD = AR, SS = MC

6.3. Short run - one factor (usually capital) is fixed

6.4. Long run, all are variable

6.5. Increased productivity reduces AC (e.g. division of labour)

6.6. Economies of scale

6.6.1. Technical - production process

6.6.2. Financial - lower borrowing interest rates

6.6.3. M.E.S, lowest point on LRAC

7. Profit maximisation

7.1. My Cat = My Rat, then area Q*(AR-AC)

7.2. Normal profit = just enough to keep factors in current use

7.3. Supernormal is anything above normal

7.4. Short run go out of business if MR < AVC, Long run go out of business if MR < AC

7.5. Principle agent problem

7.5.1. Owners of business don't run it, specialists do

7.5.2. Can reduce it buy offering workers shares

7.5.3. Asymmetric information

8. Price discrimination

8.1. Try to minimise consumer surplus

8.2. Do this by targeting people.. (degrees)

8.2.1. (i) by willingness to pay

8.2.2. (ii) by selling batches, increase market share

8.2.3. (iii) by time, geography and status. Segments of market

8.3. People with inelastic demand end up paying more

9. Monopoly

9.1. Good

9.1.1. High R+D investment, can afford it

9.1.2. Benefit from maximum EoS

9.2. Bad

9.2.1. Limit supply to raise prices - deadweight loss

9.2.2. X inefficiency, not productively efficient

9.2.3. No incentive to innovate or push boundaries

9.2.4. Limited choice for consumers as smaller firms either get priced out or bought

10. Oligopoly

10.1. Features

10.1.1. Interdependence and/or uncertainty (leads to kinked demand curve)

10.1.2. Barriers to entry

10.1.3. Product discrimination - non price competition

10.2. Collusive (act as monopoly)

10.2.1. Achieve joint profit maximisation

10.2.2. Must exert control over supply

10.2.3. Fewer firms is better, and each firm must be monitored

10.3. Competitive (tacit collusion)

10.3.1. Act as if colluding - kinked demand curve

10.3.2. Price leader sets price and the rest follow

10.3.3. Game Theory

10.3.3.1. Comes from imperfect information

10.3.3.2. Actions based on likely behaviour of competitors