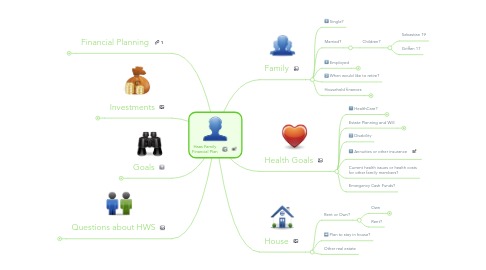

1. Financial Planning

1.1. Right Capital

2. Goals

2.1. Why did you contact me now?

2.2. Have you worked with an advisor before?

2.3. Have you ever created a financial plan before?

2.4. (don't list the 3 questions above but start conversation with it as well as I find it easier to see visual agendas. This is what I normally go over, but what would you like to talk about today in our 30 minutes together?

2.5. What life goals? After retirement, or travel, or boat, or education or charity....?

3. Family

3.1. Single?

3.2. Married?

3.2.1. Children?

3.2.1.1. Sebastian 19

3.2.1.2. Griffen 17

3.3. Employed

3.3.1. Hutzler

3.4. When would like to retire?

3.5. Household finances

3.5.1. Bookeeping and bills

3.5.1.1. Income and Expenses

3.5.1.1.1. Accounting and Taxes

4. Health Goals

4.1. HealthCare?

4.1.1. Insurance type, deductable...

4.1.1.1. HSA?

4.2. Estate Planning and Will

4.2.1. Life Insurance

4.2.1.1. Term, Whole, Variable?

4.3. Disability

4.4. Annuities or other insurance

4.5. Current health issues or health costs for other family members?

4.6. Emergency Cash Funds?

5. Investments

5.1. Types of accounts

5.1.1. Taxable

5.1.1.1. Brokerage

5.1.1.2. DIY

5.1.2. Tax Defered

5.1.2.1. 401K

5.1.2.1.1. any matching?

5.1.2.2. IRA

5.1.3. Roth IRA or 401K

5.1.4. Other retirement (SEP...)

5.1.5. Charitable

5.2. Investing style

5.3. Understanding of different investment products, including fee structure, taxes...

5.4. Private Business Assets?

6. House

6.1. Rent or Own?

6.1.1. Own

6.1.1.1. Mortgage

6.1.1.2. Rate&years remaining

6.1.1.2.1. Mortgage to principal percentage

6.1.2. Rent?

6.2. Plan to stay in house?

6.3. Other real estate

7. Questions about HWS

7.1. FEE ONLY

7.2. Savings per year

7.3. Flat Fee for every client

7.4. Examples of conflict of interest

7.5. My experience

7.6. Investment management and real risk

7.6.1. First we evaluate all combined investments and show asset allocation across accounts

7.6.2. We'll review risk and see if you have too much...or not enough based on your goals.

7.6.3. Since our flat fee is fair value, you pay any commissions (another conflict of interest if we paid commissions). But we pass on all rates we get from negotiated discounts. For example, we might use some of the investable funds to robo advise at Betterment. We get a discount that a retail investor would not get if you signed up directly. We'll pass that discount on to you as well as any trading costs we might save.