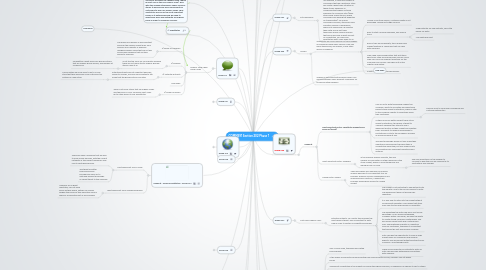

1. VanReality Potential Entrants- Medium High- It's hard to establish a good network of customer base because there are many rivals who might be willing to provide the similar service at a cheaper commission rate(maybe no commission for new entrant as their entry tactic)

1.1. We didn't pick supplier power because it is very unlikely for the home owners to collectively increase the prices, however, depending on specific location of certain houses. Moreover, if the economic condition is dipping down, the homeowners will have less power to drive prices

2. VAnalyst - financial institution - Group 214

2.1. Most significant force: rivalry

2.1.1. There are many companies that are able to offer similar services, with the current instability in this market consumers may look to switching services

2.1.2. The threat of better financial services provided by more up-to date and reliable technology is a great threat to the company

2.2. Least significant force: Bargaining power

2.2.1. Suppliers are in great quantities, can not drive prices as they desire, neither can buyers bargain the prices as they need this service which is an essential part of any business

3. Substitutes are an important force to our industry. There are many different ways for consumers to purchase food. The biggest issue is the already established views of non-organic foods. Since most consumers view non-organic foods as acceptable, they choose to purchase the cheaper good (which in most case is the non-organic food). Also, with the already established "super" grocery stores, it has become more convenient for customers to buy non-organic foods. Thus, substitutes are one of the most important forces as it determines how we need to effectively price and distribute our organic foods in order to maximize revenue.

4. 1) Substitutes

5. Which of the five forces is the most important for your industry? Why?

6. Group 211

6.1. Organic Food Chain Good Foods

6.1.1. 3) Power of Suppliers

6.1.1.1. The power of suppliers is less important because the organic market buys from specific local markets or specially designed organic labels that are not big brand name suppliers that sell their goods to everyone.

6.1.2. 4) Rivalries

6.1.2.1. Is not the top force for our industry because there are not many strictly organic grocery stores if any at all

6.1.2.1.1. Competition might arise from grocery stores that sell organic goods as well, and perhaps at a lower price

6.1.3. 5) Potential Entrants

6.1.3.1. Potential Entrants are not important because, similar to rivalries, are very much related to the AREA that the grocery store is located.

6.1.3.1.1. Communities are more likely to go to a local store that they have been loyal customers too instead of a new store.

6.1.4. New node

6.1.5. 2) Power of Buyers

6.1.5.1. There's not many stores that sell organic foods and the price is HIGH. so Buyers can't really go to other places to buy substitutes.

7. Group 212

7.1. MoveIT

7.1.1. Rivalry

7.1.1.1. Doesn't have a unique value proposition

7.1.1.1.1. Customers have other options, not obligated to stay loyal or to use company

7.1.1.1.2. Numerous competitors that are roughly equal in size and power

7.1.1.1.3. No switching costs

7.1.1.2. Slow industry growth

7.1.2. Potential Entrants

7.1.2.1. Little or no barrier to entry

7.1.3. Buyers

7.1.3.1. Little product differentiation

7.1.3.2. Customers have all the power

7.1.4. Less important

7.1.4.1. Substitutes

7.1.4.1.1. No other industries that provide same service

7.1.5. New node

8. Group 213

8.1. Good Foods Canada

8.1.1. Suppliers

8.1.1.1. By having a good relationship with suppliers, one will be able to lower their prices (gain a competitive advantage).

8.1.1.2. Most supermarkets already supply buyers with organic alternatives.

8.1.2. Substitutes

8.1.2.1. Consumers can grow their own food at home, its cheaper.

8.1.2.2. Non- organic food is cheaper, people may shift towards it

8.1.2.3. People eat out.

8.1.2.4. Those that want to live an exclusively organic life, are limited to their choices.

8.1.3. Competition

8.1.3.1. Large organic grocery stores have greater buying power, can potentially buy for cheaper.

8.1.3.2. Traditional competition is important because we have to convince them on why they should purchase organic food over regular food.

8.1.3.2.1. They need to maintain an accessible website that competes with traditional grocery stores.

8.1.3.3. low number of direct competitors (organic food), therefore they are quite established. Stronger buying power.

8.1.4. Suppliers and Substitutes are both really important to this company. Competition is notable, but suppliers and substitutes decide the success of the company

9. Group 216

10. Group 219

10.1. We believe that Rivalry is the most important of the five forces for the MoveIt company because there are a lot of similar moving companies that offer the same services. Thus, we would consider the rivalry to be high.Therefore, we believe that rivalry is one of the main forces.

10.1.1. All moving companies want to be the most efficient for their customers, and they want to provide reliable service. It's hard to find a differentiating factor for their competitive advantage when all the companies are trying to provide the same service

10.1.1.1. There are so many different companies offering their services, that it is hard to differentiate between them. How do you leave a lasting impression in potential consumers minds through advertising? (Tough)

10.1.2. New node

10.2. As this industry has great demand, "Potential Entrants" could also be one of the more important of the five forces. We consider to this to be a medium force for the MoveIt company. It is medium because there exist some barriers to entry for new companies entering the moving industry, and they have to invest a large amount of money in securing trucks and moving supplies. As well, the fact that there are already so many moving companies in Vancouver, it could serve as a discouraging factor for newer companies to enter the moving industry.

10.3. Substitute products and services would not be as much of an acting force in this industry, as there are not a lot of substitutes in different industries for moving services. Mainly, those who are moving have the choice to either move their own furniture themselves or utilize a moving service. As such we consider this force to be low for the MoveIt company.

11. Group 220

12. Group 218

12.1. Rivalry is one of the most important forces because there are several companies that offer the same services as MoveIT. Also since it's a relative new company, it might be difficult to compete in terms of pricing.

12.2. Buyer power is also crucial since customers have several potential options to choose from. However it is not the most important because if you choose an appropriate target market and differentiate your product successfully, you will have customers.

12.2.1. New node

12.3. Substitutes is another force because if people have their own cars or trucks they will not require the services of MoveIT. It is not as important though because people will still need a moving service when dealing with large/heavy furniture.

13. Group 215

13.1. City WorkForce

13.1.1. Balance Between Supplier and Buyer Power

13.1.1.1. Since the company is a temp agency, the company is at the mercy of the supply + demand of jobs

13.1.1.2. Example: during a period of high unemployment (ex. a recession), supply is high (supplier power low) and companies are more likely to hire temp employees (low buyer power)

13.1.1.2.1. People just want to have a job, so workers are more willing to go to a temp agency

13.1.1.2.2. New node

13.1.2. Buyer Power is more important

13.1.2.1. Since the main source of income comes from the companies who hire CityForce's workers

13.1.2.1.1. The Buyer's employment situation is the deciding factor in the companies income. The higher the buyer power,

14. New node

15. Group 201

15.1. Industry:Medical Services

15.1.1. **Power of Buyers: Moderate/High you gain revenues through attracting patients (building relationships)

15.1.2. Power of Suppliers: Low, you don't rely heavily on any specific suppliers

15.1.3. Threat of Substitutes: Moderate/High, self-diagnosis on the internet

15.1.4. Threat of New Entrants: Low/Moderate

16. Group 202

16.1. City WorkForce

16.1.1. Traditional Competition

16.1.1.1. Disadvantage at not being international; missing out on international company's work

16.1.1.2. Establishing relationships is a challenge

16.1.1.3. The nature of human capital - where are our potential employees going?

16.1.1.4. Could gain advantage by developing a rating system, employers may find them more reliable

16.1.1.5. Success of recruiters matching right people to right jobs

16.1.1.6. High barrier to entry as there are many agencies available

16.1.2. We chose traditional competition because in a recession, our suppliers (temp workers) and buyers (companies) are in need and other temp agencies will be trying to capitalize on this

17. Group 203

17.1. VanRealty

17.1.1. Many real estate companies - some are large in size, others are smaller

17.1.1.1. little product differentiation -

17.1.1.1.1. slowing growth of real estate - stagnation - poor economy, people not buying houses

17.1.1.2. large ones have more power on market

17.1.1.2.1. add value with quality/amount of service - higher commission

18. Group 204

18.1. City Workforce

18.1.1. Buyers- Consumers determine the amount of traffic a company receives (for example, in retail the number of consumers that like a particular store will create a high traffic situation in these stores. Especially in companies that require a strong employee to consumer ratio (think stores such as electronics, where consumers are seeking the expertise of its associates). So long as consumers increase, stores will seek a greater number of employees, which City Workforce can provide them with. We do not think temporary human resources work that we do will have a great amount of competition, so rivalry and substitutes won't really apply to us.

19. Group 205

19.1. MoveIT

19.1.1. Substitutes are a big concern for this company as consumers have many choices. They can move themselves, ask friends, or use other service companies

19.1.1.1. Usually a one time service, customer loyalty is not developed. People just judge on price

19.1.1.2. Easy to start a moving company, only need a truck

19.1.1.2.1. High potential for new entrants, very little barrier for entry

19.1.1.2.2. Low switching cost

19.1.1.3. Even if they are immigrants, they usually have friends/relatives in Vancouver that can help with moving in

19.1.1.4. They need a value proposition that sets them apart from other moving services such as UHaul. They can focus on making it effortless for the consumer and MoveIT can figure out all the logistics and details.

19.1.1.5. Furniture stores also provide delivery

19.1.2. Supplier is not important because MoveIT can choose between many different companies for trucks and other supplies

20. Group 206

20.1. VAnalyst

20.1.1. Most important factor: substitute products and services (threat)

20.1.1.1. Lack of up-to-date technology impairs the company' ability to accurately and effectively predict stock market fluctuations, which is vital to the company's ability to effectively serve their customers

20.1.1.1.1. This will result in consumer confidence and customer satisfaction

20.1.1.2. If other firms can better predict these stock market fluctuations, this poses a threat to VAnalyst because they stand to lose a significant portion of their market and clientele base. The ability to respond accordingly to fluctuations is vital to the company's success as a financial analyst firm

20.1.1.3. The new technology would not only make their operations more efficient and give them a competitive advantage, but also lowers costs accumulated from inefficient operations and systems.

20.1.2. Least important factor: suppliers

20.1.2.1. In the financial analysis industry, the only supplier of information or other resources is the stock market, which is uncontrollable by any individual firm or force.

20.1.2.1.1. The only importance of the supplier to VAnalyst is how the firm will respond to its fluctuations and changes

20.1.3. Middle factor: buyers

20.1.3.1. There will always be a demand for financial analysis because it is an important tool for business financial success. Regardless of any individual buyer's actions, VAnalyst will probably always have access to a viable market.

21. Group 207

21.1. Data Med Medical Clinic

21.1.1. Potential Entrants- as a factor this provides the most harmful threat. This is important to Data Med in order to sustain a competitive business

21.1.1.1. The market is not restricted to new entrants into the industry. Due to the lack of barriers to entry. The government does not provide any regulation.

21.1.1.2. It is also easy to enter into the market without Government regulation. This means that other firms can start up and become a competitor

21.1.1.3. The advantage the Data Med has is first mover advantage. As an already established company within Vancouver, we have the ability to create strong consumer relationships. This will ensure repeat visits and a lasting cash flow. The healthcare industry is a sensitive issue for customers, therefore it is important that we are the first and primary company

21.1.1.4. Data Med has the opportunity to claim a large market share for consumers and medical experts. This will prevent potential entrants from coming in and stealing profits

21.1.1.5. There is also difficulty for entrants to enter as Data Med will have established connections with suppliers.

22. Group 208

22.1. Suppliers (Goodfoods)

22.1.1. Only a small chain, therefore has limited buying power.

22.1.2. If the supply of products becomes limited from environmental forces, suppliers can set higher prices

22.1.3. Significant competition in the market for buying the organic produce, so suppliers can choose to sell to others.

22.1.4. We didn't pick rivalry because they are differentiated from competition.

22.1.5. We did not pick buyers, because the buyers cannot buy in large amounts, and individually do not have significant power. Also, the product is differentiated, so if they want Goodfoods' service, they need to go to Goodfoods.

22.1.6. We did not choose potential entrants, because it is very expensive for new entrants to enter the market, creating a very significant barrier to entry.

23. Group 209

23.1. Substitue services is the most significant force affecting the City Workforce

23.1.1. Substitue Businesses which could affect the performance of the City Workforce may include recruitment agencies

23.1.1.1. New node

23.1.2. Carrer colleges allow potential customers an alternate option, rather than working for a temporary employment agency like the City Workforce

23.1.3. Online job posting sites may also threaten the performance of the City Workforce which is a more conventional temporary hiring agency

23.2. Did not consider Buyers or Suppliers as being a significant force affecting the City Workforce as there will always be unemployed people looking for work, and companies needing temporary labour. In this company we have determined that the unemployed labourers are the suppliers, and the companies looking for employees are the buyers

23.3. Because the traditional temporary employment agencies are becoming phased out of the industry as there are several new online opportunities for employment, we do not believe that the City Workforce will be severely impacted by traditional competition

23.4. Potential Entrants is also considered as a significant force affecting the company, but not quite as severe as substitute services. Potential entrants into the may include similar businesses with slightly different business models which may be more appealing to people looking for temporary work.

24. Group 210

24.1. GOOD FOODS CANADA We believe that Supplier Power and Threat of Substitute Products and Services have the greatest effect on our industry

24.2. Supplier Power

24.2.1. High - Significant power - GF is only a "small chain" operating in Vancouver B.C.

24.2.1.1. Farms usually work with large stores and provide large quantities

24.2.2. Farmers have domination of supply since they are the only ones providing the goods required by the company

24.2.3. Farmers able to set high prices since they are only suppliers in industry (acts as a monopoly)

24.2.4. Since the farming industry is perfectly competitive, Good Foods should focus on smaller farms which have less power and would be more willing to collaborate and supply at a cheaper price

24.3. Threat of Substitute Products and Services

24.3.1. High - Consumers are able to readily move towards non-organic foods if price charged are too high or if consumer needs aren't being met

24.3.2. It could also be high if buyer propensity towards substitutes is high or if switching costs are low