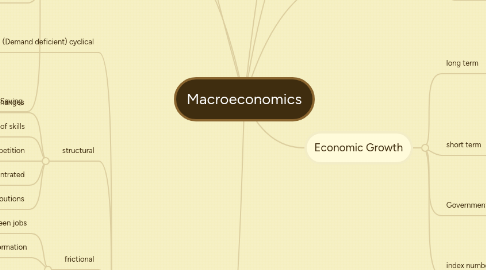

1. unemployment

1.1. (Demand deficient) cyclical

1.1.1. negative output gap

1.1.2. Reduced aggregate demand

1.1.3. Soloutions

1.1.3.1. Expansionary fiscal policy

1.1.3.2. Expansionary monetary policy

1.2. structural

1.2.1. structure of the economy changes

1.2.2. Mismatch of skills

1.2.3. Growth of international competition

1.2.4. Regionally concentrated

1.2.5. soloutions

1.2.5.1. Promote occupational and geographical mobility

1.3. frictional

1.3.1. in between jobs

1.3.2. imperfect information

1.3.3. Soloutions

1.3.3.1. reduce benefits to increase incentive

1.3.3.2. Increase job vacancy information

1.4. Classical

1.4.1. Real wage is above the labour market equilibrium

1.4.2. Soloutions

1.4.2.1. decrease minimum wage

1.4.2.2. decrease union power

1.5. seasonal

1.5.1. Regular fluctuations in weather

1.6. Someone of working age out of work and actively seeking employment

1.7. economically inactive

1.7.1. not seeking work

1.7.2. education/training

1.7.3. retired early

1.7.4. caring for for family

1.8. Governments push unemployment down

1.8.1. Had to be over 18 to register for benefits

1.8.2. Encouraged early retirement

1.8.3. 2 week lag

1.9. How it is measured

1.9.1. claimant count

1.9.1.1. number claiming unemployment

1.9.2. Labour force survey

1.9.2.1. quarterly survey of 6000 households

1.9.2.2. International comparison

1.9.3. LFS higher than Claimant count

1.10. Costs of unemployment

1.10.1. loss of income for individuals

1.10.2. loss of skills

1.10.3. cost of benefits

1.10.4. loss of tax revenue

2. AD and saving

2.1. consumer

2.1.1. Economic cycle

2.1.2. Unemployment

2.1.3. tax cuts

2.1.4. interest rates

2.1.5. exchange rate

2.1.6. housing prices

2.2. investement

2.2.1. tax cuts

2.2.2. Interest rates

2.2.3. Business confidence

2.2.4. Subsidies

2.3. Governement

2.3.1. Debt

2.3.2. Economic cycle

2.3.3. Tax revenue

2.3.4. Unemployment

2.4. Saving

2.4.1. Interest rates

2.4.2. Economic cycle

2.4.3. Debt

2.4.4. Risk aversion

2.4.5. short term stock performance

3. Macroeconomics

3.1. economic cycle

3.1.1. output gaps

3.1.1.1. negative/positive

3.1.2. boom

3.1.2.1. rising Inflation

3.1.3. recession

3.1.3.1. real output falls for two consecutive quarters

3.1.3.2. Increases unemployment

4. Inflation

4.1. cost push

4.1.1. Oil, raw materials

4.2. demand pull

4.2.1. Economic growth

4.3. real/nominal

4.4. index numbers

4.5. The general and sustained rise in the price level

5. Economic Growth

5.1. long term

5.1.1. The continuous outward shift of the productive capacity of an economy.

5.1.2. Trend

5.1.2.1. 2% since WWII

5.1.3. Increases the total productive capacity

5.1.4. Capital goods will shift the PPF more than consumer goods

5.2. short term

5.2.1. annual % change in GDP

5.2.2. Uses the spare capacity in and economy

5.3. Government Intervention

5.3.1. Demand side

5.3.1.1. monetary policy

5.3.1.2. fiscal policy

5.3.2. Supply side

5.3.2.1. Supply side policices

5.4. index numbers

5.4.1. base year = 100

5.4.2. easier to view percentage change over time

6. Current account

6.1. Deficit

6.1.1. More Imports than exports

6.2. Goods

6.2.1. Tangible products

6.3. Services

6.3.1. Financial, law, media etc.

6.4. Exports-imports

6.5. Surplus

6.5.1. More exports than imports