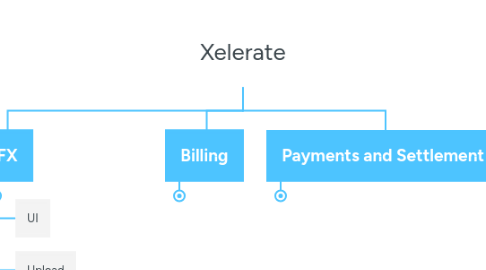

1. Billing

1.1. Bill Processing

1.1.1. Invoice

1.1.1.1. Schedule Management

1.1.1.1.1. Billing Group

1.1.1.1.2. Billing Schedule

1.1.1.2. Scheduled Invoice

1.1.1.2.1. Based on Billing Group

1.1.1.2.2. Based on Process Date

1.1.1.2.3. Based on application date(Project IDFC)

1.1.1.2.4. Service

1.1.1.3. On-demand Invoice

1.1.1.3.1. UI

1.1.1.3.2. Service

1.1.1.4. Intermediate Invoice

1.1.1.4.1. Manual

1.1.1.4.2. Automatic

1.1.1.4.3. UI(X2 only)

1.1.1.4.4. Service

1.1.1.5. Manual Invoice

1.1.1.5.1. UI

1.1.1.5.2. API(X2 only)

1.1.1.5.3. Service(X2.5 only)

1.1.1.6. Trial Invoice(X2 only)

1.1.1.6.1. UI

1.1.1.6.2. Service

1.1.1.7. Enquiry

1.1.1.7.1. Enquiry Service

1.1.1.7.2. Enquiry UI

1.1.1.8. Processes

1.1.1.8.1. Open

1.1.1.8.2. Process

1.1.1.8.3. Close

1.1.1.8.4. Invoice Re-open(Project Amex)

1.1.1.9. Process Modes

1.1.1.9.1. Fresh

1.1.1.9.2. Reprocess

1.1.1.10. Invoice Number Management

1.1.1.10.1. Sequence

1.1.1.10.2. User Hook

1.1.1.11. Invoice Currency Management

1.1.1.11.1. Customer Currency

1.1.1.11.2. Account Currency

1.1.1.11.3. Pricing Currency(Project Commerzbank)

1.1.1.12. Bill Level

1.1.1.12.1. Customer

1.1.1.12.2. Account

1.1.1.12.3. Bill Type(X2 only)

1.1.2. Statements(X2 only)

1.1.2.1. Statement Schedule

1.1.2.2. Statement view

1.1.2.3. Statement process

1.1.2.3.1. Statement level

1.1.2.3.2. Approval

1.1.2.4. Enquiry

1.2. Post billing(X2 only)

1.2.1. Reprint Invoice Address

1.2.2. Dispute

1.2.2.1. Dispute

1.2.2.1.1. Level

1.2.2.1.2. Adjustment method

1.2.2.2. Resolution

1.2.2.3. Charge reversal

1.2.3. Write Off

1.2.3.1. Single Write Off

1.2.3.2. Auto write off

1.3. Reports

1.3.1. CAMT

1.3.2. Amount written off report

1.3.3. Accrual Revenue Trend

1.3.4. Actual Revenue Trend

1.3.5. Account Analysis Report

1.3.6. Ageing Analysis Report

1.3.7. Direct Debit Report

1.3.8. Direct Debit Transaction Level Report

1.3.9. Invoice Details Report

1.3.10. Invoice Summary Report

1.3.11. Invoice over Threshold Amount Report

1.3.12. Invoice Over Threshold Variation Report

1.3.13. Revenue Analysis Report

1.3.14. Settlement Details Report

1.3.15. Charge Reversal Report

1.3.16. Customer Account Revenue report

2. Payments and Settlement

2.1. Create Payment(X2.5)

2.1.1. Cash

2.1.1.1. Payment Collection Levels

2.1.1.1.1. Customer Level

2.1.1.1.2. Account Level

2.1.1.1.3. Bill Level

2.1.1.2. Payment status

2.1.1.2.1. Full Payment

2.1.1.2.2. Excess Payment

2.1.1.2.3. Partial Payment

2.1.1.3. Manual(online) Payment

2.1.1.3.1. UI

2.1.1.3.2. API

2.1.1.4. Batch Payment

2.1.1.4.1. UI

2.1.1.4.2. Payment Upload

2.1.1.4.3. API

2.1.2. Direct Debit

2.1.2.1. Modes(P)

2.1.2.1.1. Assumed

2.1.2.1.2. Notified

2.1.2.2. Process

2.1.2.2.1. Request

2.1.2.2.2. Response

2.1.2.2.3. Retry

2.1.2.2.4. Request Hold

2.1.2.2.5. Error Logging

2.2. Allocation

2.2.1. Full payment

2.2.2. Partial payment

2.2.3. Excess Payments

2.2.4. Negative Bills(X2 only)

2.2.5. Accountable credit voucher(X2 only)

2.3. Payment Cancellation(X2 only)

2.3.1. Manual Allocation

2.3.2. Write off

2.3.3. Wrong Account and Amount

2.3.4. Wrong Account Identified

2.3.5. Payment reassign

2.3.5.1. Wrong Account un identified

2.4. Refund

2.4.1. Direct Credit Process

2.4.2. Negative Bills(X2 only)

2.4.3. Charge reversal

2.4.3.1. Payment enquiry

2.4.3.2. File upload

2.4.3.3. CUD based

2.4.3.4. PTD based

2.4.4. Charge write off

2.4.4.1. Payment enquiry

2.4.4.2. File upload

2.4.4.3. CUD based

2.4.4.4. PTD based

2.4.5. Refund vouchers(X2 only)

2.5. Follow up(Only for bill based in X2)

2.5.1. Follow up scheme

2.5.2. Actions

2.5.2.1. Email

2.5.2.2. Letter