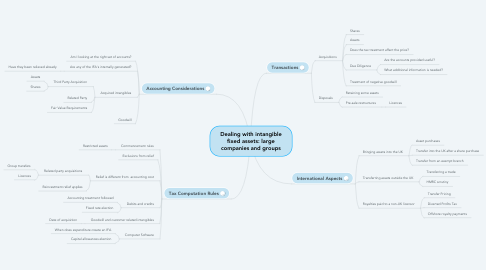

1. Transactions

1.1. Acquisitions

1.1.1. Shares

1.1.2. Assets

1.1.3. Does the tax treatment affect the price?

1.1.4. Due Diligence

1.1.4.1. Are the accounts provided useful?

1.1.4.2. What additional information is needed?

1.1.5. Treatment of negative goodwill

1.2. Disposals

1.2.1. Retaining some assets

1.2.2. Pre-sale restructures

1.2.2.1. Licences

2. International Aspects

2.1. Bringing assets into the UK

2.1.1. Asset purchases

2.1.2. Transfer into the UK after a share purchase

2.1.3. Transfer from an exempt branch

2.2. Transferring assets outside the UK

2.2.1. Transferring a trade

2.2.2. HMRC scrutiny

2.3. Royalties paid to a non-UK licensor

2.3.1. Transfer Pricing

2.3.2. Diverted Profits Tax

2.3.3. Offshore royalty payments

3. Accounting Considerations

3.1. Am I looking at the right set of accounts?

3.2. Are any of the IFA's internally generated?

3.2.1. Have they been relieved already

3.3. Acquired intangibles

3.3.1. Third Party Acquisition

3.3.1.1. Assets

3.3.1.2. Shares

3.3.2. Related Party

3.3.3. Fair Value Requirements

3.4. Goodwill

4. Tax Computation Rules

4.1. Commencement rules

4.1.1. Restricted assets

4.2. Exclusions from relief

4.3. Relief is different from accounting cost

4.3.1. Related party acquisitions

4.3.1.1. Group transfers

4.3.1.2. Licences

4.3.2. Reinvestment relief applies

4.4. Debits and credits

4.4.1. Accounting treatment followed

4.4.2. Fixed rate election

4.5. Goodwill and customer related intangibles

4.5.1. Date of acquisition

4.6. Computer Software

4.6.1. When does expenditure create an IFA

4.6.2. Capital allowances election