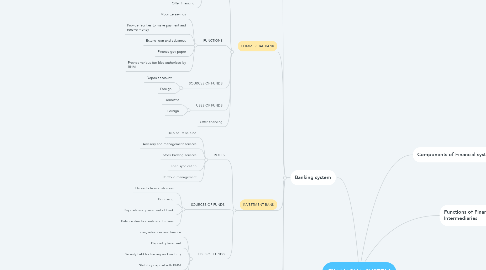

1. Banking system

1.1. BNM

1.1.1. Issue currency

1.1.2. Keeper of international reserve and safeguard the exchange rate

1.1.3. Act as banker and financial advisor to the government

1.1.4. Banker to other banks

1.1.5. Promote monetary stability and sound financial structure

1.2. COMMERCIAL BANK

1.2.1. ROLES

1.2.1.1. Raise fund from deposit

1.2.1.2. Current account facilities

1.2.1.3. Accept deposit

1.2.1.4. Offer financing

1.2.2. FUNCTIONS

1.2.2.1. Mobilize savings

1.2.2.2. Provide facilities to make payment and receive money

1.2.2.3. Extend loan and advances

1.2.2.4. Finance gov paper

1.2.2.5. Provide various facilities authorized by BNM

1.2.3. SOURCES OF FUNDS

1.2.3.1. Deposit account

1.2.3.2. Foreign

1.2.4. USES OF FUNDS

1.2.4.1. Domestic

1.2.4.2. Foreign

1.2.5. Offer financing

1.3. INVESTMENT BANK

1.3.1. ROLES

1.3.1.1. Help co. raise fund

1.3.1.2. Advisory and management services

1.3.1.3. Stock broking services

1.3.1.4. Loan syndication

1.3.1.5. Portfolio management

1.3.2. SOURCES OF FUNDS

1.3.2.1. Deposits from customers

1.3.2.2. Borrowing

1.3.2.3. Deposits and placement of bank

1.3.2.4. Balance due to clients and brokers

1.3.3. USES OF FUNDS

1.3.3.1. Loan, advances and finance

1.3.3.2. Deposit placement

1.3.3.3. Security held for trading and maturity

1.3.3.4. Statutory deposit with BNM

1.3.3.5. Investment into subsidiary co.

1.4. NBFI

1.4.1. PROVIDENT AND PENSION FUND

1.4.2. INSURANCE COMPANY

1.5. ISLAMIC BANKING

1.5.1. PRINCIPLE

1.5.1.1. Based on shariah laws

1.5.1.2. Prohibition of riba'

1.5.1.3. Contractual relationship

1.5.1.4. Equity participation

1.5.2. OBJECTIVES

1.5.2.1. Offer financial services

1.5.2.2. Economic development

1.5.2.3. Optimum resources allocation

1.5.2.4. Optimum approach

1.5.2.5. Facilitate stability in Money value

1.5.3. SOURCES OF FUNDS

1.5.3.1. Saving and Investment

1.5.4. USES OF FUNDS

1.5.4.1. Financing

1.5.4.2. LOC

1.5.4.3. Bank guarantee

1.5.4.4. Islamic accepted bills

2. Functions of Financial Intermediaries

2.1. Lower transaction costs

2.2. Reduce risk exposure

3. Components of Financial system

3.1. Financial institution

3.2. Financial instruments

3.3. Provider and user of fund

4. FINANCIAL MARKETS

4.1. CAPITAL MARKET

4.1.1. Bond and Equity instruments are traded

4.2. DERIVATIVES MARKET

4.2.1. Derivatives securities are traded

4.3. OFFSHORES MARKET

4.3.1. Deals with any kind of currencies