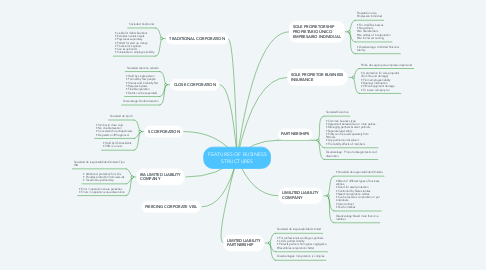

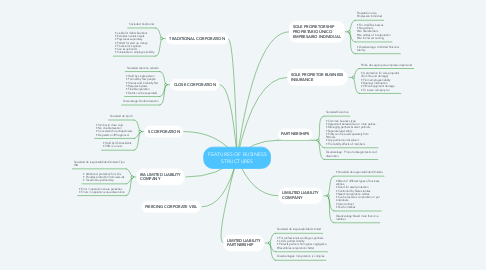

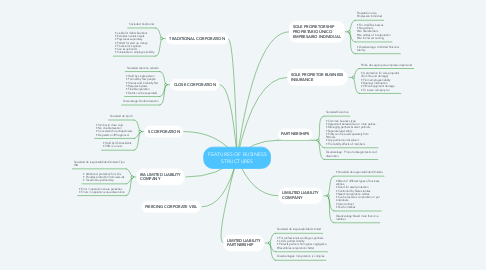

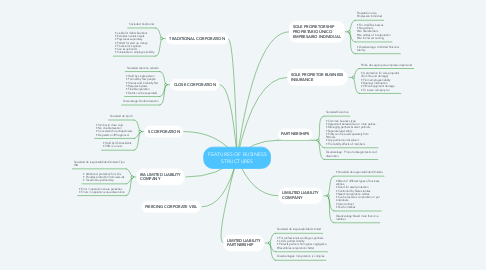

FEATURES OF BUSINESS STRUCTURES

by SEPULVEDA CARVAJAL DAVID

1. PIERCING CORPORATE VEIL

2. IRA LIMITED LIABILITY COMPANY

2.1. Sociedad de responsabilidad limitada Tipo IRA

2.2. • Additional protection for LLCs • Provides protection from lawsuits • Taxed like a partnership

2.3. • Error in operation ensue penalities • Errors in operation ensue dissolution

3. TRADITIONAL CORPORATION

3.1. Sociedad tradicional

3.2. • Liable for debts & actions • Excludes owners assets • Pays taxes separately • Perfect for start up money • Financial risk spread • Can issue bonds • Vulnerable to employee liability

4. CLOSE CORPORATION

4.1. Sociedad anónima cerrada

4.2. • Held by single person • Formed by few people • Shares sold internally first • Requires bylaws • Flexible operation • Debts can be separated

4.3. Disavantage: Double taxation

5. S CORPORATION

5.1. Sociedad de tipo S

5.2. • Similiar to close corp. • No double taxation • Convenient for entreperneurs • Depends on IRS approval

5.3. • Held by USA residents • SSN is a must

6. LIMITED LIABILITY PARTNERSHIP

6.1. Sociedad de responsabilidad Limitad

6.2. • For professionals working as partners • Limits partner liability • Protects partners from gross negligence •Resembles corporation charter

6.3. Disadvantages: Incoporation is complex

7. SOLE PROPIETORSHIP PROPIETARIO ÚNICO EMPRESARIO INDIVIDUAL

7.1. Propietario único Empresario Individual

7.2. • For small Businesses • No partners •No Shareholders •No articles of incorporation •No formal accounting

7.3. • Disadvantage: Unlimited Personal liability

8. SOLE PROPIETOR BUSINESS INSURANCE

8.1. Póliza de seguro para empresa unipersonal

8.2. • A protection for sole propietor (from fire and damage) • From employee liability • Business interruption • Office Equipment damage • To insure company car

9. PARTNERSHIPS

9.1. Sociedad Colectiva

9.2. • Common business type • Agreement between two or more parties. • Managing partners & silent partners • Separate legal entity • Entity can be sued separately from Partners. • Any partner can dissolve it • The liability affects all members

9.3. Disadvantage: Prone to disagrements and dissolution.

10. LIMILITED LIABILITY COMPANY

10.1. • Sociedad de responsabilidad limitada

10.2. • Blend of different types of business entities. • Good for asset protection • Controlled by State statutes • Need incorporation articles • Can be taxed as corporation or per individuals. • Own contract • Few formalities

10.3. Disadvantage: Need more than one member.