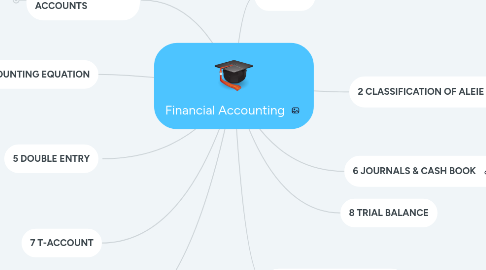

1. 3 IDENTIFICATION OF ACCOUNTS

1.1. OWNER INVEST CASH (CASH, CAPITAL)

1.2. PURCHASE GOODS BY CASH (,)

2. 4 ACCOUNTING EQUATION

3. 5 DOUBLE ENTRY

4. 7 T-ACCOUNT

5. 9 ADJUSTMENTS

6. 1 THEORY

6.1. branch of accounting

6.2. ACCOUNTING CONCEPTS

6.3. ACCOUNTING ASSUMPTION

6.4. DIFFERENT TYPES OF BUSINESS ORGANISATION

6.4.1. SOLE PROP

6.4.2. PARTNERSHIP

6.4.3. COMPANIES

6.4.3.1. PRIVATE

6.4.3.2. PUBLIC

6.4.3.3. CLBG

7. 2 CLASSIFICATION OF ALEIE

7.1. ASSETS

7.1.1. Intangible Assets

7.1.1.1. patent

7.1.1.2. GOODWILL

7.1.1.3. COPYRIGHTS

7.1.1.4. BRAND

7.1.1.5. TRADEMARK

7.1.2. Non-current Assets

7.1.2.1. motor vehicle

7.1.2.2. property

7.1.2.2.1. LAND

7.1.2.2.2. BUILDING

7.1.2.3. OFFICE EQUIPMENT

7.1.2.3.1. computer

7.1.2.4. MACHINERY

7.1.2.5. FURNITURE

7.1.2.6. INVESTMENT

7.1.3. Current Assets

7.1.3.1. cash / bank

7.1.3.2. stock / inventory

7.1.3.3. AC RECEIVABLES / DEBTOR

7.1.3.4. PREPAID EXPENSE

7.2. LIABILITIES (DEBT)

7.2.1. Current Liabilities

7.2.1.1. wages payable / accrued wages

7.2.1.2. bank overdraft

7.2.1.3. income tax payable

7.2.1.4. SHORT TERM BANK LOAN

7.2.1.5. AC PAYABLE / CREDITOR

7.2.1.6. INTEREST PAYABLE

7.2.2. Non-current Liabilities

7.2.2.1. long term debt

7.2.2.2. LONG TERM BANK LOAN

7.2.2.3. MORTGAGE

7.3. EQUITY

7.3.1. Capital

7.3.1.1. Capital / Modal

7.3.1.2. Share Capital

7.3.1.3. (-) drawings

7.3.1.4. SHARE PREMIUM

7.3.2. retained earnings

7.3.2.1. profit prior year

7.3.2.2. profit this year

7.3.3. Reserve

7.4. INCOME

7.4.1. direct income

7.4.1.1. sales

7.4.1.2. revenue

7.4.2. indirect income

7.4.2.1. discount received

7.4.2.2. dividend received

7.4.2.3. interest received

7.4.2.4. commission received

7.5. EXPENSES

7.5.1. direct expenses

7.5.1.1. cost of goods manufactured

7.5.1.2. cost of goods sold

7.5.1.2.1. purchase of goods

7.5.1.2.2. transport in / carriage inwards

7.5.1.2.3. custom duty on the goods from suppliers

7.5.2. indirect expenses

7.5.2.1. ADMINISTRATIVE EXPENSES

7.5.2.1.1. REPAIRS AND MAINTENANCE

7.5.2.1.2. bad debt

7.5.2.1.3. UTILITIES

7.5.2.1.4. INSURANCE

7.5.2.1.5. OFFICE EXPENSES

7.5.2.1.6. wages

7.5.2.2. SELLING AND DISTRIBUTION EXPENSES

7.5.2.2.1. carriage outwards / transport out

7.5.2.2.2. custom duty of goods to customer

7.5.2.2.3. ADVERTISING

7.5.2.3. FINANCE COST

7.5.2.3.1. INTEREST EXPENSE

7.5.2.3.2. BANK CHARGES

8. 6 JOURNALS & CASH BOOK

8.1. Sales Journal - list down all ac receivables

8.2. Sales Return Journal - list down all return from customers

8.3. Purchase Journal - list down all ac payable

8.4. Purchase Return Journal - list down all return to suppliers

8.5. General Journal - other transactions

8.6. Cash book - all transactions involve cash and bank

9. 8 TRIAL BALANCE

10. 10 FINANCIAL STATEMENTS

10.1. STATEMENT OF PROFIT OR LOSS / INCOME STATEMENT

10.1.1. INCOME

10.1.2. EXPENSES

10.2. STATEMENT OF FINANCIAL POSITION / BALANCE SHEET

10.2.1. ASSETS

10.2.2. LIABILITY

10.2.3. EQUITY