1. How to solve this problem? The institution or bank can shifted to an underwriting model in which they originate or warehouse loans, and then quickly sell them (originate and distribute)

1.1. the Basel I capital regulations is made in order to reduce the risk. It is a capital standard requirement which is its rule to hold more capital against risky loans and other assets

1.2. Capital is the most important source of funds to the bank institutions since it is viewed as the first line of defences against unpredictable losses

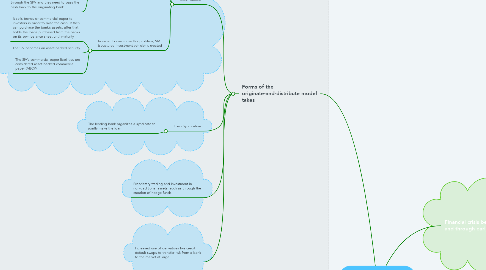

2. Forms of the originate-and-distribute model takes

2.1. Securitization

2.1.1. A bank packages loans into asset-backed securities such as mortgage-backed securities, collateralized debt obligations, collateralized loan obligations, and so on

2.1.2. SPVs (special-purpose vehicle) was used; the activities of selling the asset-backed securities directly to investors in order to raise cash

2.1.2.1. The SPV purchased assets from the originating bank for cash generated from the sale of ABSs. The SPV then sells the newly created asset backed securities to investors, and subsequently earned fees from the creation and servicing of the asset-backed securities

2.1.2.2. However, the asset pool belong to the investors. All cash flows were only passed through the SPV and they need to pass the cash back to the originating bank

2.1.3. In order to overcome this problem, SIV (structured investment vehicle) is created

2.1.3.1. It sells bonds or commercial paper to investors in order to raise the cash. It then can purchase the bank’s assets, after that holds the loans purchased from the banks on its own balance sheet until maturity

2.1.3.2. The SIV becomes an asset-backed security

2.1.3.3. The SIV’s commercial paper liabilities are considered asset-backed commercial paper (ABCP)

2.2. Loan Syndication

2.2.1. The lending bank organizes a syndicate to jointly make the loan

2.3. Proprietary trading and investment in non-traditional assets, such as through the creation of hedge funds

2.4. Increased use of derivatives like credit default swaps to transfer risk from a bank to the market at large

3. Financial crisis began in late 2006 and through early 2007

3.1. Dramatic increase in systemic risk of the financial system, caused in large part by a shift in the banking model from that of ‘‘originate and hold’’ to ‘‘originate and distribute.’’

3.2. The bank takes short-term deposits and other sources of funds and uses them to fund longer-term loans to businesses and consumers

4. The bank holds these loans to maturity (originate and hold)

4.1. Has an incentive to screen and monitor borrower activities even after the loan is made

4.2. This method exposes the institution to potential liquidity risk, interest rate risk, and credit risk

4.2.1. Once in the early 1980s, the interest rates increased. This happened as the deposit rates increased above mortgage rates, and automatically the banks earned a negative return. This also resulted in their long-term fixed-rate loans as they became unprofitable