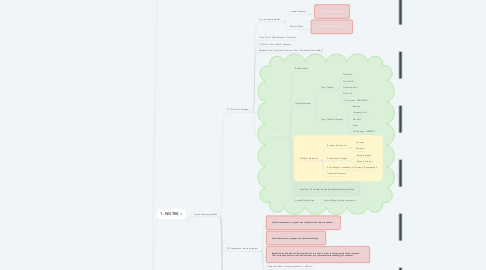

1. 2. CUES

1.1. Topic 2 Measuring Wealth

2. 0. Course Info.

2.1. Source: edX - ImperialBusinessX - ICBS001

2.2. Course End Date: Oct. 31, 2020

2.3. Language of Business

2.4. Financial Accouting

2.5. Management Accounting

2.6. Essentials for MBA Success

3. 1. NOTES

3.1. Topic 2 Measuring Wealth

3.1.1. 2.1 The income statement

3.1.1.1. How to measure wealth?

3.1.1.1.1. Income Statement

3.1.1.1.2. Balance Sheet

3.1.1.2. Gross Profit = Sales Revenue - Direct Cost

3.1.1.3. Net Profit = Gross Rpofit - Expenses

3.1.1.4. Retained Profit = Net Profit - (Interest + Tax + Dividends to Shareholders)

3.1.1.5. Annual Accounts

3.1.1.5.1. Balance Sheet

3.1.1.5.2. Income Statement

3.1.1.5.3. Director's Statement

3.1.1.5.4. Fiscal Year (12 months) - September/December/January/March

3.1.1.5.5. Audited/Non-Audited

3.1.2. 2.2 Preparing the income statement

3.1.2.1. Credit transactions = payment was made after the sale or purchase.

3.1.2.2. Cash transaction = payment was made immediately.

3.1.2.3. Expenditures: This leads to the acquisition of resources in order to help generate future revenues. Thus purchasing a achine, new land and plant, etc, represents cash spending, not expenses.

3.1.2.4. Trade receivables = account receivables = debtors

3.1.2.5. Trade payables = account payables = creditors

3.1.2.6. Inventory = stock

3.1.3. 2.3 The balance sheet

3.1.3.1. Consept: the accounting equation

3.1.3.1.1. Assets = Claims

3.1.3.1.2. Assets = Liability + Equity (Capital)

3.1.3.1.3. Founding

3.1.3.2. The time horizon of the balance sheet is static.

3.1.3.2.1. It relates to one point in time, typically the last day of the financial period i.e. it is the snapshot of the financial position as of that day.

3.1.4. 2.4 The format of the balance sheet

3.1.4.1. Balance sheet is always divided into assets, liabilities and equity (with the last two being claims on those assets).

3.1.4.2. Assets should be listed starting with the most permanent, e.g. Land Buildings, ending with the least permanent, e.g. cash.

3.1.4.3. Equity = Net Assets

3.1.4.4. US (FASB/GAAP) vs International (IASB/IFRS)

3.1.5. 2.5 Preparing the balance sheet

3.1.6. 2.6 How the income statement relates to the balance sheet

3.1.6.1. The value of the business can be found by looking at the balance sheet and its three major elements - assets, liabilities and equity.

3.1.6.2. The equity value can only be calculated once the profit from the income statement is known.

3.1.7. 2.7 Real-world valuation of assets

3.1.7.1. How limitations in the information content of the balance sheet can lead to differing valuations by the different constituents in a company or corporation.

3.1.7.1.1. Historic cost

3.1.7.1.2. Complementary concepts

3.1.8. 2.8 Test your knowledge: Measuring wealth