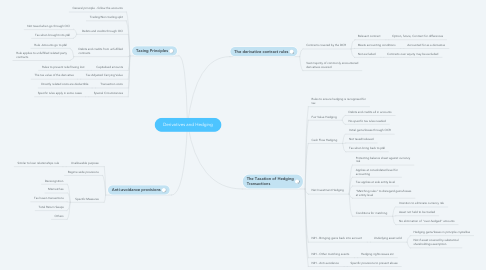

1. The derivative contract rules

1.1. Contracts covered by the DCR

1.1.1. Relevant contract

1.1.1.1. Option, future, Contract for differences

1.1.2. Meets accounting conditions

1.1.2.1. Accounted for as a derivative

1.1.3. Not excluded

1.1.3.1. Contracts over equity may be excluded

1.2. Vast majority of commonly encountered derivatives covered

2. The Taxation of Hedging Transactions

2.1. Rules to ensure hedging is recognised for tax

2.2. Fair Value Hedging

2.2.1. Debits and credits all in accounts

2.2.2. No specific tax rules needed

2.3. Cash Flow Hedging

2.3.1. Initial gains/losses through OCR

2.3.2. Not taxed/relieved

2.3.3. Tax when bring back to p&l

2.4. Net Investment Hedging

2.4.1. Protecting balance sheet against currency risk

2.4.2. Applies at consolidated level for accounting

2.4.3. Tax applies at sole entity level

2.4.4. "Matching rules" to disregard gains/losses at entity level

2.4.5. Conditions for matching

2.4.5.1. Intention to eliminate currency risk

2.4.5.2. Asset not held to be traded

2.4.5.3. No elimination of "over-hedged" amounts

2.5. NIH - Bringing gains back into account

2.5.1. Underlying asset sold

2.5.1.1. Hedging gains/losses in principle crystallise

2.5.1.2. Not if asset covered by substantial shareholdings exemption

2.6. NIH - Other matching events

2.6.1. Hedging rights issues etc

2.7. NIH - Anti avoidance

2.7.1. Specific provisions to prevent abuse

3. Taxing Principles

3.1. General principle - follow the accounts

3.2. Trading/Non trading split

3.3. Debits and credits through OCI

3.3.1. Not taxed when go through OCI

3.3.2. Tax when brought into p&l

3.4. Debits and credits from unfulfilled contracts

3.4.1. Rule -Amounts go to p&l

3.4.2. Rule applies to unfulfilled related party contracts

3.5. Capitalised amounts

3.5.1. Rules to prevent relief being lost

3.6. Tax Adjusted Carrying Value

3.6.1. The tax value of the derivative

3.7. Transaction costs

3.7.1. Directly related costs are deductible

3.8. Special Circumstances

3.8.1. Specific rules apply in some cases

4. Anti-avoidance provisions

4.1. Unallowable purpose

4.1.1. Similar to loan relationships rule

4.2. Regime wide provisions

4.3. Specific Measures

4.3.1. Derecognition

4.3.2. Mismatches

4.3.3. Tax haven transactions

4.3.4. Total Return Swaps

4.3.5. Others