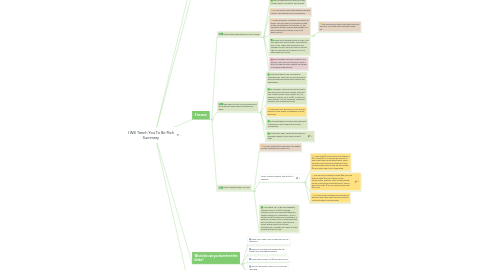

1. 1-Sentence-Summary:

1.1. I Will Teach You To Be Rich helps you save money on autopilot while allowing yourself to spend guilt-free on the things you enjoy.

2. Favorite quote from the author:

2.1. "Getting started is more important than becoming an expert." - Ramit Sethi

3. 3 lessons:

3.1. Start taking responsibility for your money

3.1.1. Start accepting you’re the one in the cockpit, when it comes to your money.

3.1.2. No one likes to admit that they’re bad with money. Even though a lot of people are.

3.1.3. There are plenty of people and factors to blame. Like the media, confusing you with all this contradictory information. Or the education system, which never taught you how to spend your money, save it, let alone invest it.

3.1.3.1. But excuses will always stay what they are: excuses. No matter how right they might be.

3.1.4. Saving and investing money is scary, and you might lose some money, but better to lose it now, rather than tomorrow. The younger you are, the more risk you should take on, because it’s still easy for you to make back the money.

3.1.5. Even though it will take a while to see results, if you can only afford to invest a little, you should never neglect the power of compounding interest.

3.2. Take fixed cuts off your paycheck and automatically spend them towards your goals

3.2.1. Have what Ramit calls a Conscious Spending Plan. Take cuts off your paycheck and automatically spend them towards the right things.

3.2.2. For example: Use 60% of your income to pay fixed costs, like rent, utilities, food and your credit card bill. Then, invest 10%, for example in stocks, your 401(k), or Roth IRA. Save another 10% for vacations, Christmas presents and unexpected costs.

3.2.3. This leaves you with 20% of your money, which you can spend on whatever you like, guilt-free.

3.2.4. Automate these processes and payments to ensure you don't spend that money accidentally.

3.2.5. As with any habit, removing the need for willpower makes it a lot easier to get it right.

3.3. Start investing today. No joke.

3.3.1. You will regret every single day you waited to start investing once you’re old.

3.3.2. Here's a great example, that puts it in numbers.

3.3.2.1. If you invest $5,000 every year (which is $417/month) for 10 years, from age 25 to age 35 and then never invest again, you’d still have more money at retirement, than someone who starts at age 35 and invests $5,000 every year UNTIL they retire.

3.3.2.2. The 25 year old starter invests $55,000 and ends up with $615,000 (given an 8% annual return, which is close to the average return of the stock market per year). The 35 year old invests $130,000 and ends up with $431,000.

3.3.2.3. You can invest less than half and end up with one and a half times as much money! Just by starting 10 years earlier.

3.3.3. I Will Teach You To Be Rich suggests maxing out your 401(k) to get the maximum from your employer (they will usually match your contribution, up to a certain point) and then also investing in a Roth IRA, another form of retirement plan, but one that you control, and lifecycle funds, which invest your money automatically, shifting from riskier to safer investments as you age.